Advertisement|Remove ads.

Lucid CEO Clarifies Recent Fundraise Was A Strategic Decision: Retail Remains Wary

Last week, when electric vehicle-maker Lucid Group Inc ($LCID) announced its public offering, its shares plunged nearly 18%.

Now, CEO Peter Rawlinson told CNBC it was a timely, strategic business decision to shore up enough capital for the firm’s ongoing operations and growth plans.

“We’d signaled that we had a cash runway to Q4 next year. As a Nasdaq company, we have to avoid a going concern. And a going concern is issued within 12 months of your financial runway,” Rawlinson said, according to the report. “So, it should have been no surprise to anybody.”

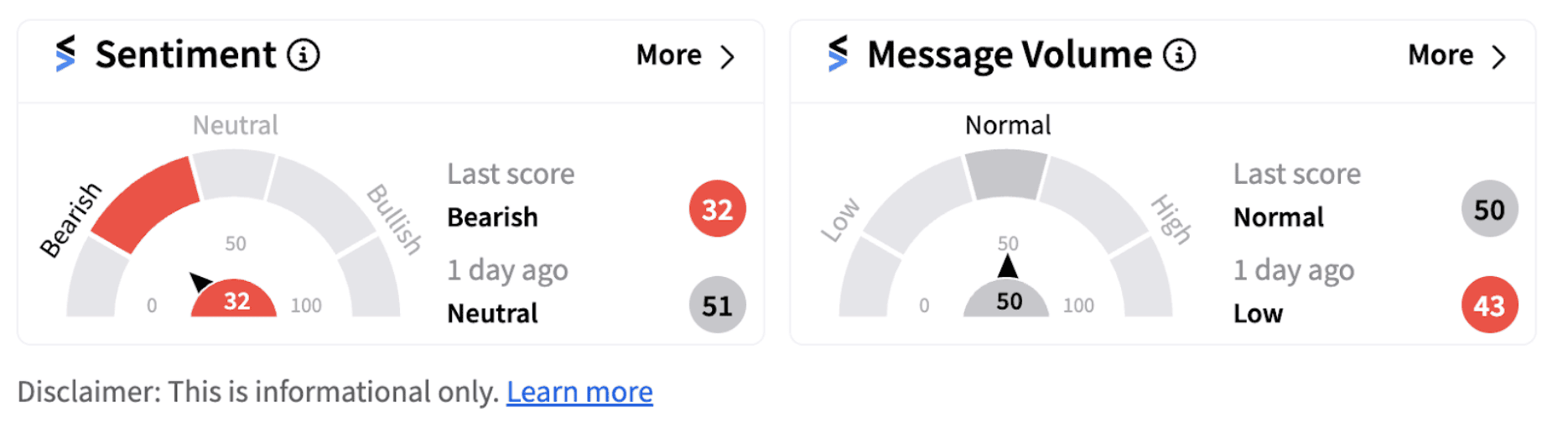

Despite the clarification, retail sentiment on Stocktwits trended in the ‘bearish’ territory (32/100) compared to ‘bullish’ a day ago.

On Thursday, Lucid said it will raise gross proceeds of $1.67 billion through its public offering of common stock and corresponding investment by an affiliate of Public Investment Fund (PIF).

The firm had also entered into an agreement with its majority stockholder Ayar Third Investment Company. Under the agreement, Ayar had agreed to purchase over 374 million shares of common stock from Lucid in a private placement, at the same price initially paid by the underwriter in the public offering.

The company intends to use the net proceeds from the public offering and from the private placement for general corporate purposes, which may include, among other things, capital expenditures and working capital.

However, RBC Capital Markets analyst Tom Narayan had reportedly expressed skepticism on the timing of the offering. “We suspect that investors will wonder why LCID is raising more capital just after it secured the PIF capital in August, and at currently depressed share price levels. We expect Lucid shares to trade sharply lower as a result,” he had stated.

Meanwhile, shares of Lucid are down by over 38% since the beginning of the year.

Also See: Cheniere Energy Sees China’s Gas Demand Booming By 2040, Poised To Become First 100MT LNG Market

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sarepta_Therapeutics_jpg_6cce13dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_conocophillips_resized_98da51d9b9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)