Advertisement|Remove ads.

Cheniere Energy Sees China’s Gas Demand Booming By 2040, Poised To Become First 100MT LNG Market

Liquefied natural gas producer and the largest U.S. exporter of LNG, Cheniere Energy Inc ($LNG,) reportedly expects China gas demand to increase to over 600 billion cubic meters (bcm) by 2040 compared to 400 bcm at the current juncture.

"There's no doubt that gas demand growth in China, in absolute terms, is substantially driven by energy demand, policies like coal-to-gas-switch as well as a huge infrastructure build-up,” Yingying Zhou, director LNG origination at Cheniere said at the Asia Gas Markets conference on Tuesday, according to a Reuters report.

Zhou also noted that China will soon become the world’s first 100-million-ton LNG market and LNG will account for nearly 25%-30% of the country’s overall gas demand mix.

Cheniere was in focus lately after the company received permission for a supply line. The Federal Energy Regulatory Commission issued an order that permits the firm to take LNG from the plant to refrigerated liquid storage facilities and then onto a tanker for export.

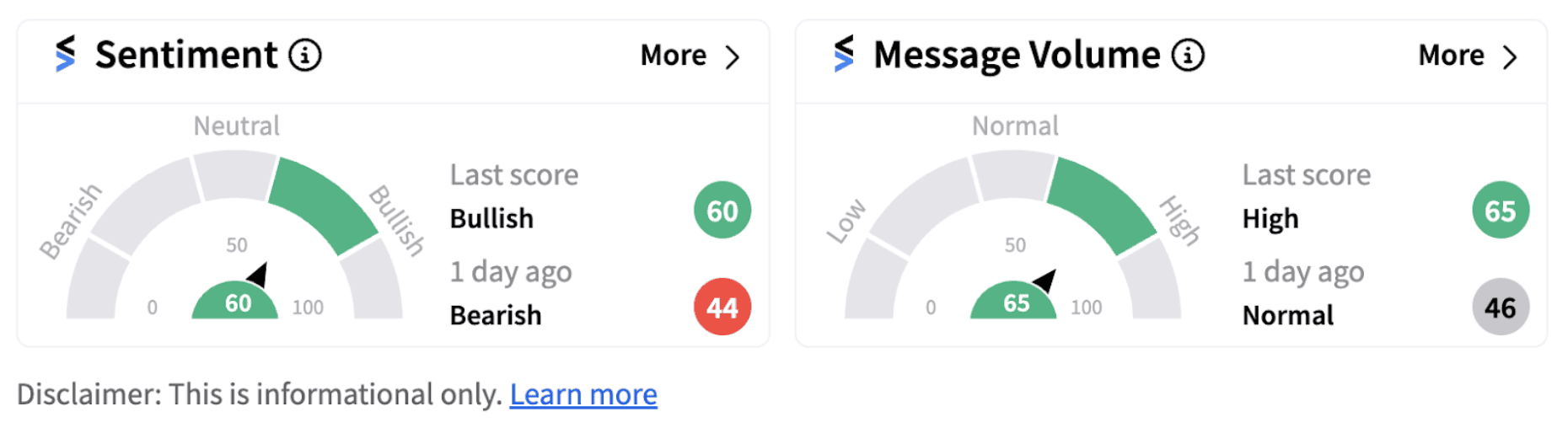

On Tuesday, retail sentiment on Stocktwits jumped into the ‘bullish’ territory (60/100) from the ‘bearish’ zone a day ago, accompanied by high retail chatter.

Recently, Bank of America Securities (BofA) reinstated its coverage of the stock with a ‘Buy’ rating and a price target of $215.

The brokerage finds Cheniere attractive given its 90% contracted cash flows, near-term marketing upside, and free cash flow growth via low cost expansions at its Sabine Pass and Corpus Christi facilities.

Notably, Cheniere is BofA’s top energy pick. The brokerage reportedly stated that its expansion at Sabine Pass, which is not included in its valuation, could provide a potential upside of $15/share.

Cheniere shares have gained over 6% since the beginning of the year, significantly underperforming the benchmark U.S. indices.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sarepta_Therapeutics_jpg_6cce13dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_conocophillips_resized_98da51d9b9.jpg)