Advertisement|Remove ads.

LUNR Stock In Spotlight Ahead Of Artemis II Launch - Can It Snap Two Weeks Of Losing Streak?

- Last week, Intuitive Machines said that NASA selected it as one of the 34 global volunteers chosen to track the Artemis II Mission.

- On Friday, NASA said that the potential opportunity to launch Artemis II is no earlier than Sunday, Feb. 8.

- NASA added that the opening of a simulated launch window during the wet dress rehearsal begins at 9 p.m. ET, Feb. 2.

Shares of Intuitive Machines declined by more than 5% last week, ending in the red for a second straight week, ahead of NASA’s Artemis II launch. Investors are closely watching the key mission as well as updates around the lunar terrain contract.

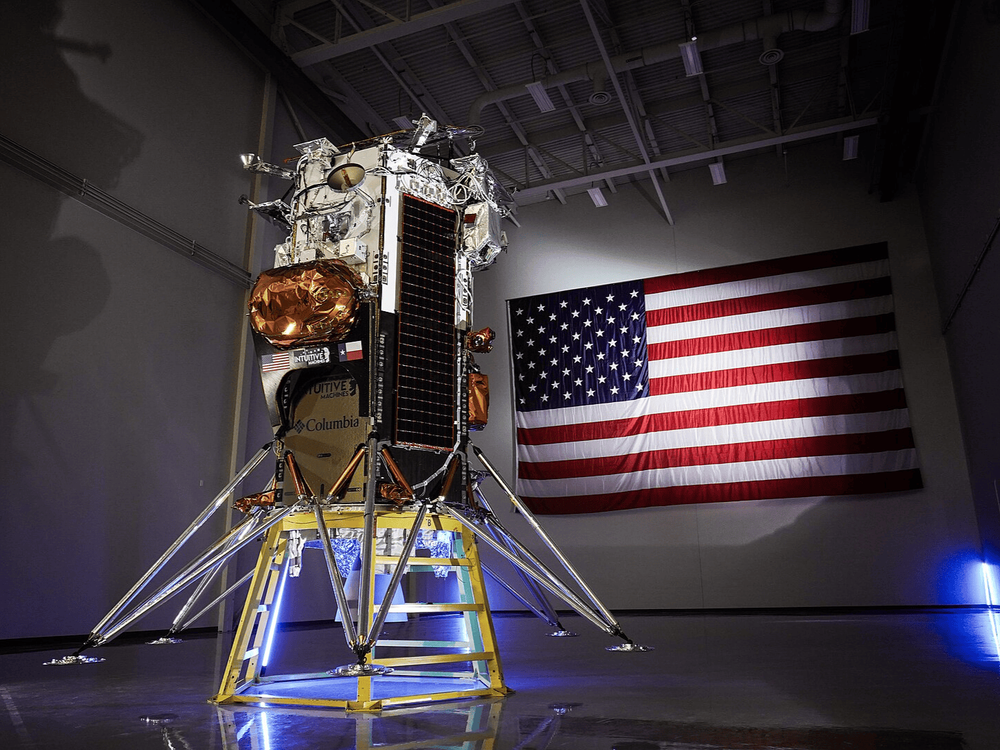

NASA selected Intuitive Machines last week as one of its 34 global volunteers to track the Artemis II mission. The company will support the mission using its Space Data Network and ground station infrastructure to track radio waves transmitted by the in-flight Artemis I Orion spacecraft.

Intuitive Machines has received NASA’s approval to track the radio waves transmitted by the Orion spacecraft during its 10-day journey to and around the Moon. LUNR stock gained for eight straight weekly sessions before posting its first weekly loss during the Jan. 23 week.

Launch Delay For Artemis II

On Friday, NASA said the potential launch of Artemis II is no earlier than Sunday, Feb. 8, a delay from the originally planned Feb. 6 date. NASA also said it was targeting Monday, Feb. 2, as the tanking day for the upcoming Artemis II wet dress rehearsal at the agency’s Kennedy Space Center in Florida, as a result of weather.

“Over the past several days, engineers have been closely monitoring conditions as cold weather and winds move through Florida. Managers have assessed hardware capabilities against the projected forecast, given the rare arctic outbreak affecting the state and decided to change the timeline,” NASA said.

NASA added that the opening of a simulated launch window during the wet dress rehearsal begins at 9 p.m. ET, Feb. 2, with the countdown beginning nearly 49 hours prior and that the agency will continue to assess weather conditions ahead of the test.

The Artemis II test flight will launch NASA’s Space Launch System rocket, carrying the Orion spacecraft and a crew of four astronauts, on a mission to deep space.

Wall Street View

Intuitive Machines had a dull 2025, with shares sliding more than 10%. The momentum appears to be turning in the new year, with the stock up 17% so far in 2026 through Friday’s close.

Last week, KeyBanc analyst Michael Leshock raised the firm's price target on Intuitive Machines to $26 from $20, according to TheFly, after several recent events and headlines directly impacted the space and defense technology industries.

KeyBanc said that it sees an ideal macro environment persisting through 2026, driving significant growth opportunities and potential re-ratings of space and defense tech equities. Stifel had also noted that an “unpredictable political climate” might introduce new uncertainty on whether the most qualified bid actually wins the competition for NASA on the lunar terrain vehicle contract.

What Is Retail Thinking?

Retail sentiment on LUNR stock improved to ‘bullish’ from ‘neutral’ a month ago, with message volumes at ‘high’ levels, according to data from Stocktwits. The ticker is on track to hit 34,000 followers on Stocktwits.

Shares of Intuitive Machines have fallen more than 12% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Eli Lilly CEO Sees Medicare Coverage Support Upcoming Obesity Pill Launch: Report

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)