Advertisement|Remove ads.

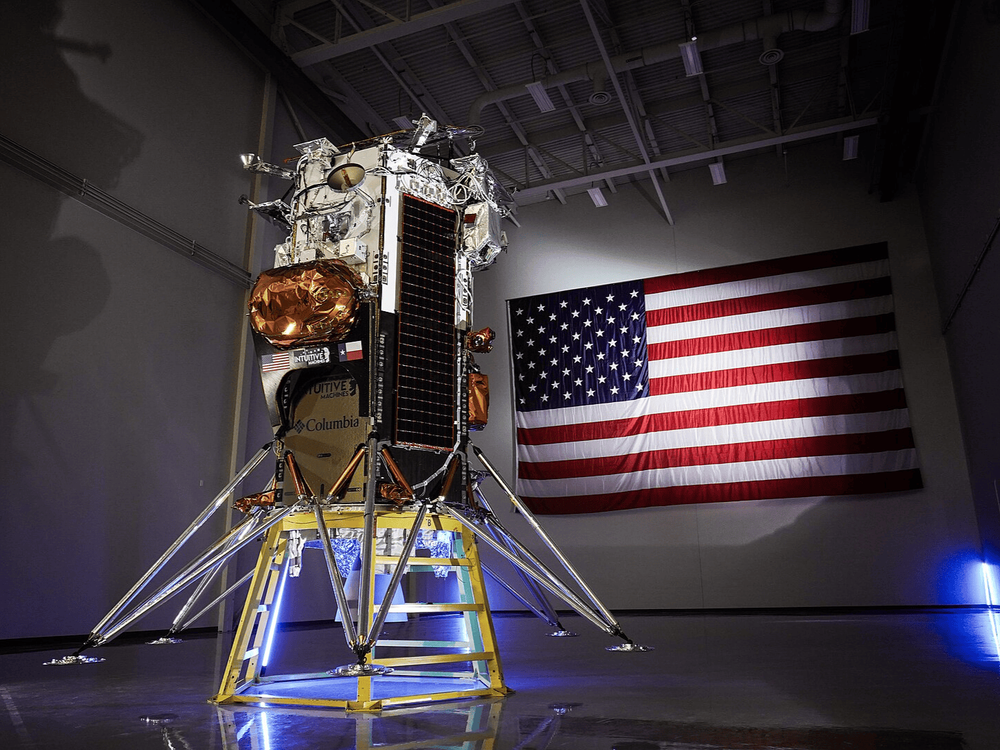

LUNR Stock To Fly Higher? Analyst Sees Revenue Doubling From NASA Contract

- Jacquar Analytics said that the success of Artemis II, with a smooth rollout, reduces the risk of budget raids, ensuring the Omnibus Multidiscipline Engineering Services III funding remains stable and allowing the company to maintain steady revenue.

- Intuitive Machines recently completed the Lanteris acquisition, and Jaquar believes that this has “quietly unlocked” a massive door into the Department of Defense.

- The company’s stock had not gained much traction in 2025, with shares sliding more than 10%, compared with the huge 610% surge it saw in 2024.

Shares of Intuitive Machines have jumped nearly 33% already in 2026 and are expected to gain more momentum as NASA begins rolling the fully stacked Artemis II rocket and Orion spacecraft out of the assembly area at the Kennedy Space Center to the launch pad.

According to Jaquar Analytics, NASA needs Intuitive Machines’ landers to scout the south pole for ice before the Space Launch System (SLS) crew attempts to land there on Artemis III. The success of Artemis II, with a smooth rollout, reduces the risk of budget raids, ensuring the Omnibus Multidiscipline Engineering Services III funding remains stable and allowing the company to maintain steady revenue, Jacquar Analytics said on Sunday.

Intuitive Machines handles engineering, launch vehicle booking, and landing for NASA, and provides high-level engineers to NASA’s Goddard Space Flight Center to work on satellite servicing, navigation, and orbital robotic maintenance.

The company’s stock had not gained much traction in 2025, with shares sliding more than 10%, compared with the huge 610% surge it saw in 2024.

Revenue To Double

The firm said that with the IM-2 launch scheduled for Feb 26, analysts are likely modeling a "Launch Milestone” quarter, and if Intuitive Machines successfully lands in early March and completes the data downlink for NASA and Nokia, they could recognize the mission as completed and send across payments within the first quarter.

This could push revenue to $140 million or more in the first quarter of the new fiscal year, effectively more than doubling the prior year's revenue, Jacquar said. The company’s first-quarter revenue in fiscal 2025 was $62.52 million.

Last week, Stifel said it believes an announcement from NASA on the lunar terrain vehicle contract is imminent. Last year, Intuitive Machines announced it had submitted its proposal for the next phase of NASA’s lunar terrain vehicle services contract to build, fly, and operate the Intuitive Machines-led Moon RACER vehicle on the Moon.

Unlocking The Golden Opportunity

Intuitive Machines recently completed the Lanteris acquisition, and Jaquar believes that this has “quietly unlocked” a massive door into the Department of Defense. The Golden Dome requires hundreds of satellites in Medium Earth Orbit and Geostationary Orbit, and before acquiring Lanteris, the company could not bid on these huge satellite manufacturing contracts.

Jacquar said that now Intuitive Machines owns the factory that builds the heavy buses or satellite bodies needed for this program. “If LUNR announces even a sub-contract win for a slice of this $151B pie, the stock could re-rate from a speculative space explorer to a prime defense contractor,” the firm said. (which commands much higher, more stable valuations).

The firm added that the buyout has also helped Intuitive gain a contract to build the walls and power of a permanent infrastructure on the moon.

How Are Retail Users Reacting?

Retail sentiment on LUNR stock dipped to ‘bullish’ from ‘extremely bullish’ a month ago, with message volumes at ‘normal’ levels, according to data from Stocktwits.

Shares of Intuitive Machines have gained 17% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)