Advertisement|Remove ads.

Lyft Stock Tumbles On Soft Q1 Forecast, But Retail Sentiment Rises To Year-High After Q4 Sales Beat

Lyft (LYFT) stock fell about 11% in after-market trade on Tuesday after the company forecast first-quarter earnings slightly below Wall Street’s estimate.

The company forecast first-quarter adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) between $90 million and $95 million, the midpoint of which came in below the average analysts’ estimate of $94.16 million, according to FinChat data.

Lyft also forecast gross bookings, which show the total transactions on the platform, between $4.05 billion and $4.20 billion. According to a Reuters report, analysts were expecting gross bookings of $4.26 billion.

The company remains locked in a price war with its larger rival, Uber, to gain market share in the U.S., Though some analysts have said that its competitive pricing would help improve rider metrics.

Lyft reported a 15% rise in gross bookings for the fourth quarter to $4.28 billion.

The San Francisco-based company’s quarterly revenue of $1.55 billion was ahead of the Street estimate of $1.54 billion.

Lyft said its active riders grew 10% year-over-year to reach a record high of 24.7 million.

The company also hit a new record in driver hours during the fourth quarter.

“We surpassed every target we provided at investor day, and the best part is that 2024 was only the beginning of our multi-year plan,” Chief Financial Officer Erin Brewer said.

Lyft also launched a share buyback program worth $500 million on Tuesday.

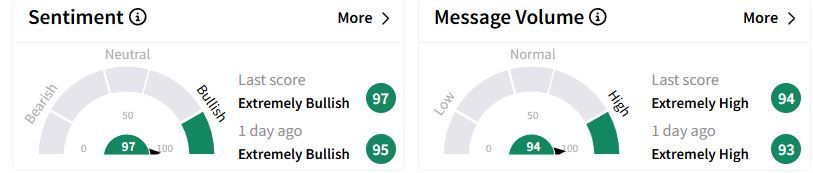

Retail sentiment on Stocktwits moved higher in the ‘extremely bullish’ (97/100) territory to hit the highest in a year, while retail chatter remained ‘extremely high.’

Some users were amused by the stock move, while others said they would buy more shares of the company if the dip continued on Wednesday.

Last week, Uber had forecast its first-quarter gross bookings also below estimates.

Over the past year, Lyft shares have gained about 16%.

Also See: LCI Industries Stock Rises After Beating Q4 Profit Estimates: Retail’s Neutral

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_122032465_jpg_9592f3bcfd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Novavax_building_93bfe3bf8c.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1470886126_jpg_f11dd80298.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)