Advertisement|Remove ads.

LCI Industries Stock Rises After Beating Q4 Profit Estimates: Retail’s Neutral

LCI Industries (LCII) stock gained 3.7% on Tuesday after its fourth-quarter revenue topped Wall Street’s estimates.

According to FinChat data, the company reported quarterly revenue of $803.14 million, compared with the average analysts’ estimate of $800.83 million.

The company reported a net income of $9.5 million, or $0.37 per share, compared with a net loss of $2.4 million, or $0.09 per share, in the same period a year ago.

However, sales declined year-over-year during the fourth quarter, hurt by lower sales to North American marine and utility trailer original equipment manufacturer (OEM) parts and declines in wholesale shipments of motorhome recreational vehicle (RV) units.

This was slightly offset by North American RV wholesale shipments of travel trailers and fifth-wheels and market share gains in the automotive aftermarket.

The Aftermarket net sales for the fourth quarter of 2024 were $181.6 million, registering an increase of 1% compared to 2023.

The company said the sales growth in the segment was primarily driven by market share gains in the automotive aftermarket, partially offset by lower volumes within the marine aftermarket.

LCI expects 2025 North American wholesale unit shipments to be 335,000 to 350,000, while retail unit shipments are expected to hit 345,000 and 360,000.

The company said its consolidated January 2025 sales were up 6% compared to last year's, boosted by a 17% increase in RV OEM sales.

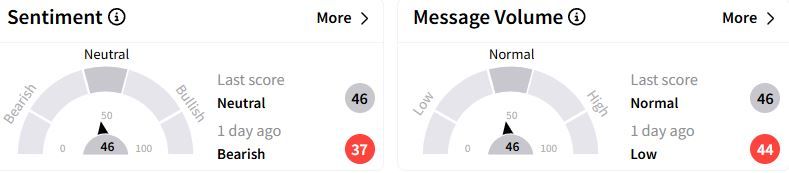

Retail sentiment on Stocktwits rose to ‘neutral’ (46/100) territory from ‘bearish’(37/100) a day ago, while retail chatter was ‘normal.’

LCI stock has fallen 9.9% over the past year and 3.4% over the past three months.

Also See: Carrier Global Stock Slips After Q4 Revenue Miss: Retail Finds Joy In Profit Beat

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235337353_jpg_bdb561432a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_strait_of_hormuz_jpg_456f2fb6d3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Intuit_resized_jpg_913ef93c15.webp)