Advertisement|Remove ads.

M&M Shares Eye Fresh Highs: SEBI RAs Highlight ₹3,000–₹3,100 Zone As Breakout Window

Mahindra & Mahindra, the flagship arm of the Mahindra Group, gained 4% on Monday following robust fourth-quarter earnings.

The company reported a 22% YoY rise in net profit to ₹2,437 crore, with revenues at ₹31,353 crore, driven by strong growth in both its automotive and farm equipment divisions.

KaranRaj Sonkusale observes that M&M shares are displaying strong bullish momentum on the weekly charts.

He identifies support levels in the ₹2,900–2,950 range, with short-term price targets at ₹3,005.10 and ₹3,100. To manage downside risk amid market volatility, he recommends a primary stop-loss at ₹2,800 and an extended stop-loss at ₹2,720.85.

Orchid Research also flagged that M&M is exhibiting notable strength following its recent results, with a surge in buying interest pushing the stock close to the ₹3,000 mark.

This level is significant because ₹3,000 is a major call writing strike price in the options market, indicating heightened activity and positioning by traders.

If a short-covering rally or panic occurs at this strike, Orchid Research suggests the stock could see an additional 3–5% upside from current levels.

Financial Sarthis highlights that M&M is currently facing resistance at ₹3,044.

A decisive close above this level would be necessary to trigger further upward movement, with potential targets set at ₹3,100 and ₹3,150, they add. On the downside, immediate support is identified at ₹2,950, which could act as a cushion against short-term declines.

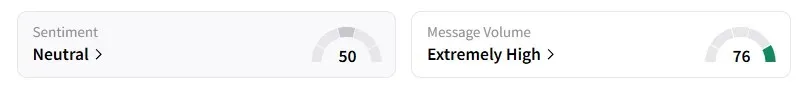

Data on Stocktwits shows that retail sentiment has remained ‘neutral’ on this counter for the last three months.

M&M shares are flat year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)