Advertisement|Remove ads.

Can Trump Make Manufacturing Great Again? 11 Stocks Retail Is Closely Watching

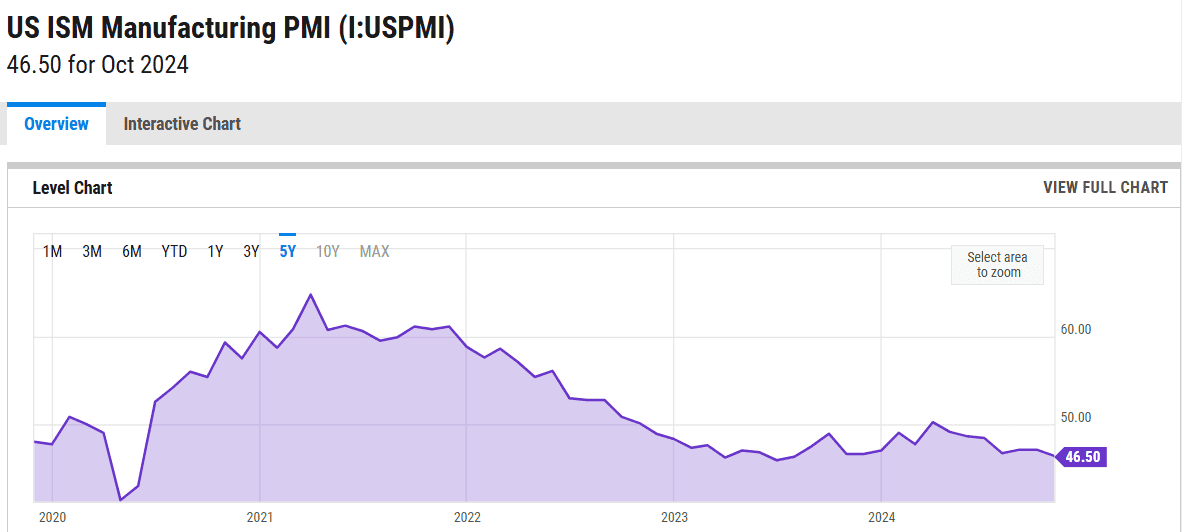

The manufacturing sector has been in a recession since November 2022, according to the Institute for Supply Management’s (ISM) manufacturing purchasing managers’ index (PMI). There could be light at the end of the tunnel, with a new administration taking charge in a little under three months following Donald Trump’s convincing win in the 2024 presidential election.

Down In Dumps

The ISM’s manufacturing PMI has been below the “50” cut-off mark that separates expansion and contraction for 23 months since Nov. 2022 and barely expanded in a month in the interim (March 2024).

The latest manufacturing PMI reading came in at 46.5 for October, which marked the fastest contraction since July 2023.

Timothy Fiore, chair of the ISM, said, “U.S. manufacturing activity contracted again in October, and at a faster rate compared to last month. Demand continues to be weak, output declined, and inputs stayed accommodative.”

He attributed the predicament to contractions in new orders and backlog of orders, and depressed customer inventory levels.

"Demand remains subdued, as companies continue to show an unwillingness to invest in capital and inventory due to concerns (for example, inflation resurgence) about federal monetary policy direction in light of the fiscal policies proposed by both major parties," Fiore said.

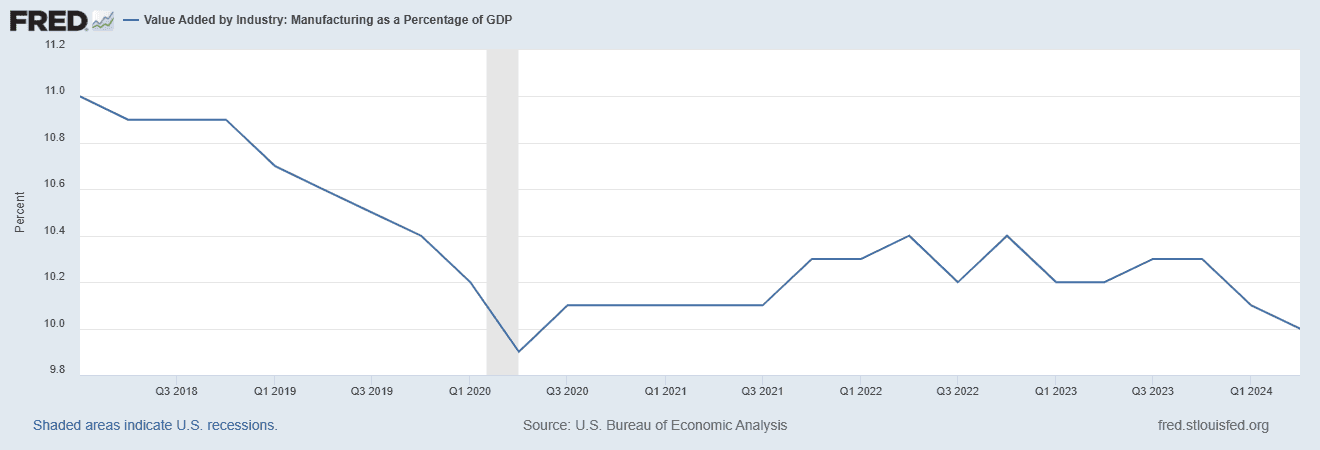

The manufacturing sector’s contribution to GDP has been on the decline, accounting for just 10% of the total GDP in the second quarter of 2024.

Revival In Cards

In a campaign speech in North Carolina in late September, Trump promised to bring about a “manufacturing renaissance” by reducing taxes, reducing energy costs, and easing regulations to attract jobs from other countries.

Fund manager Louis Navellier said in a recent note to clients that the manufacturing sector is on track to turn around.

If the new administration can help the sector to expand via tariffs against unfair competition overseas and work toward lowering energy prices, and the Federal Reserve reduces rates, the U.S. manufacturing sector can gain a competitive advantage vis-a-vis the other nations, he said.

“In theory, the U.S. should experience a manufacturing boom, especially if the natural gas industry booms and helps expand the U.S. utility grid,” Navellier said.

Retail interest in the manufacturing sector has increased amid these geopolitical developments.

Here are the most widely-tracked industrial stocks on Stocktwits and their watcher count:

Boeing Co. ($BA): 188,825

General Electric Co. ($GE): 151,848

Caterpillar, Inc. ($CAT): 31,052

Lockheed Martin Corp. ($LMT): 30,114

Tellurian, Inc. ($TELL): 25,373

3M Co. ($MMM): 23,617

SunPower Corp. ($SPWR): 23,270

RTX Corp. ($RTX): 20,148

Deere & Co. (DE): 12,158

Kratos Defense & Security Solutions, Inc. ($KTOS): 12,158

Axon Enterprises, Inc. ($AXON): 10,969

Read Next: Altimmune Stock Jumps As Obesity Drug Candidate Clears Key FDA Meeting: Retail Bulls Charge In

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)