Advertisement. Remove ads.

MARA Stock Tumbles After Earnings Miss But CEO Predicts Bitcoin Will Help Trump Fight Debt, Inflation: Retail Remains Optimistic

Shares of Marathon Digital Holdings Inc. ($MARA) dropped nearly 7% on Wednesday after the company’s third-quarter revenue missed estimates.

Marathon posted a loss of $0.34 per share, meeting Wall Street’s projections, but revenue of $131.6 million came in more than 6% below the anticipated $140.26 million.

This is the third consecutive quarter that Marathon Digital has missed Wall Street’s revenue expectations.

However, CEO Frederick Thiel is optimistic there will be a crypto-friendly regulatory environment after President-elect Donald Trump’s 2024 election win.

He stated that the U.S. is likely to set up a strategic reserve of Bitcoin ($BTC.X) in order to offset its federal debt.

“The only other alternative to paying that debt is to allow inflation to run wild and inflate down the debt, which is not something I want my children or grandchildren to have to experience,” Thiel said during MARA’s Q3 2024 earnings call.

Despite the recent dip, the Bitcoin mining company’s stock is still up 50% since Nov. 5, when President-elect Donald Trump’s 2024 election win sparked optimism in markets. However, the stock’s value has only appreciated by 4% year-to-date.

Bitcoin has rallied to record highs of over $92,000 on expectations of crypto-friendly regulations under the new administration, especially since Trump has his own NFT trading cards. ‘Series 4: The America-First Collection’ launched as a part of his electoral campaign in August, earlier this year.

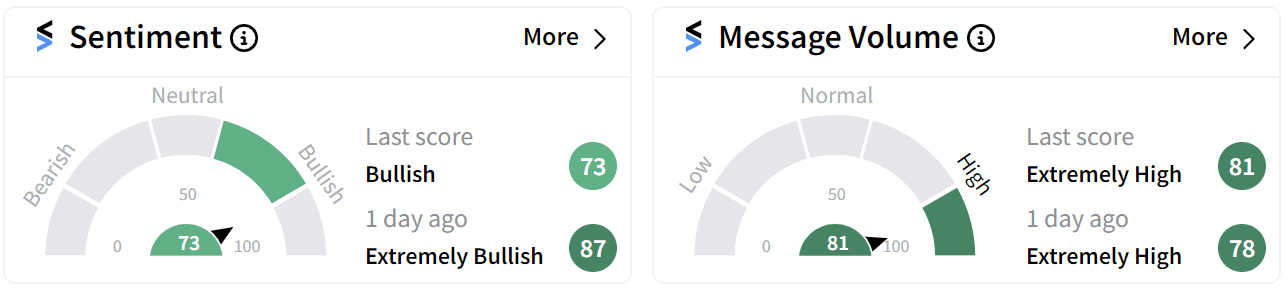

Retail sentiment on Stocktwits around MARA remains largely optimistic even though it has dipped marginally to ‘bullish’ from ‘extremely bullish’ a day ago.

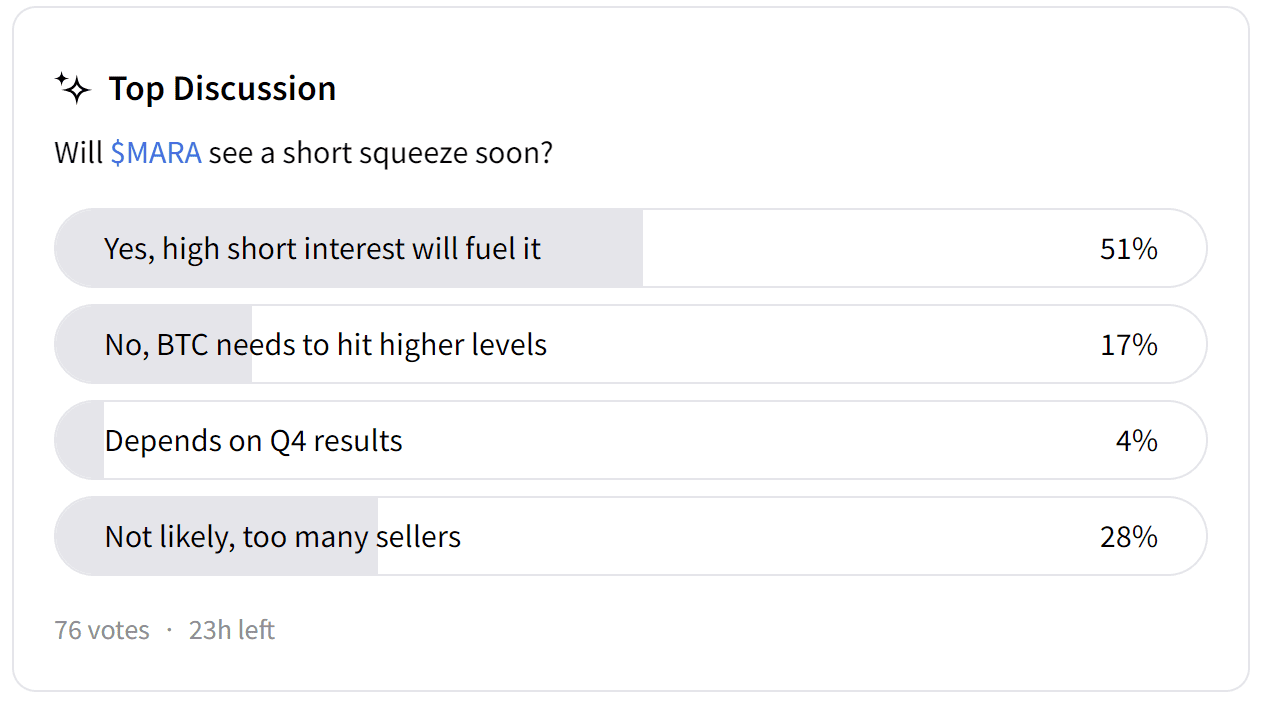

Retail investors on the platform anticipate the share price to pump back up, not due to the company’s earnings but due to short sellers covering their bets.

In the third quarter, MARA grew its Bitcoin holdings by over 8,000 coins, mining 2,070 and purchasing 6,210.

MARA now holds 26,747 Bitcoin, worth nearly $2.5 billion at the cryptocurrency's Wednesday morning price of around $92,600.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/02/shutterstock-1903314829-2025-02-2dc1254ced886a982ac4c2838375f987-scaled.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/08/gst-2025-08-0c85e16a4defd813c05e7fa63217dff5.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/02/m-nagaraju-2025-02-e1c6095fe8963ea5707d968048b969f4.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/09/nclt-2024-09-368a6a429d0365fddd99a6ca5bbf067a.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2018/06/2018-06-21T050845Z_1_LYNXMPEE5K0CB_RTROPTP_4_INDIA-ECONOMY-INFLATION.jpg)