Advertisement|Remove ads.

Genius Group Stock Nearly Doubles In Value After Announcing MicroStrategy-Like Bitcoin Treasury Plan: Retail Turns Extremely Bullish

Shares of Genius Group Ltd. ($GNS) jumped 30% as markets opened on Wednesday, building on a 66% rally from the previous session after the ed-tech company revealed plans to integrate Bitcoin into its treasury strategy akin to MicroStrategy’s ($MSTR) approach.

“The compelling case that we believe Michael Saylor and Microstrategy have made for public companies to invest in Bitcoin as their primary treasury reserve asset is one that we fully endorse,” stated Genius Group Director Thomas Power.

If the stock holds its gains through the day, the shares will have nearly doubled in value within two days.

The firm’s corporate strategy shift comes amid a crypto market surge triggered by former President-elect Donald Trump's victory in the 2024 U.S. election last week.

Genius Group plans to purchase $120 million in Bitcoin as part of its latest business plan, holding the token as a long-term reserve asset.

Ultimately, the company intends for Bitcoin to make up 90% of its treasury reserves.

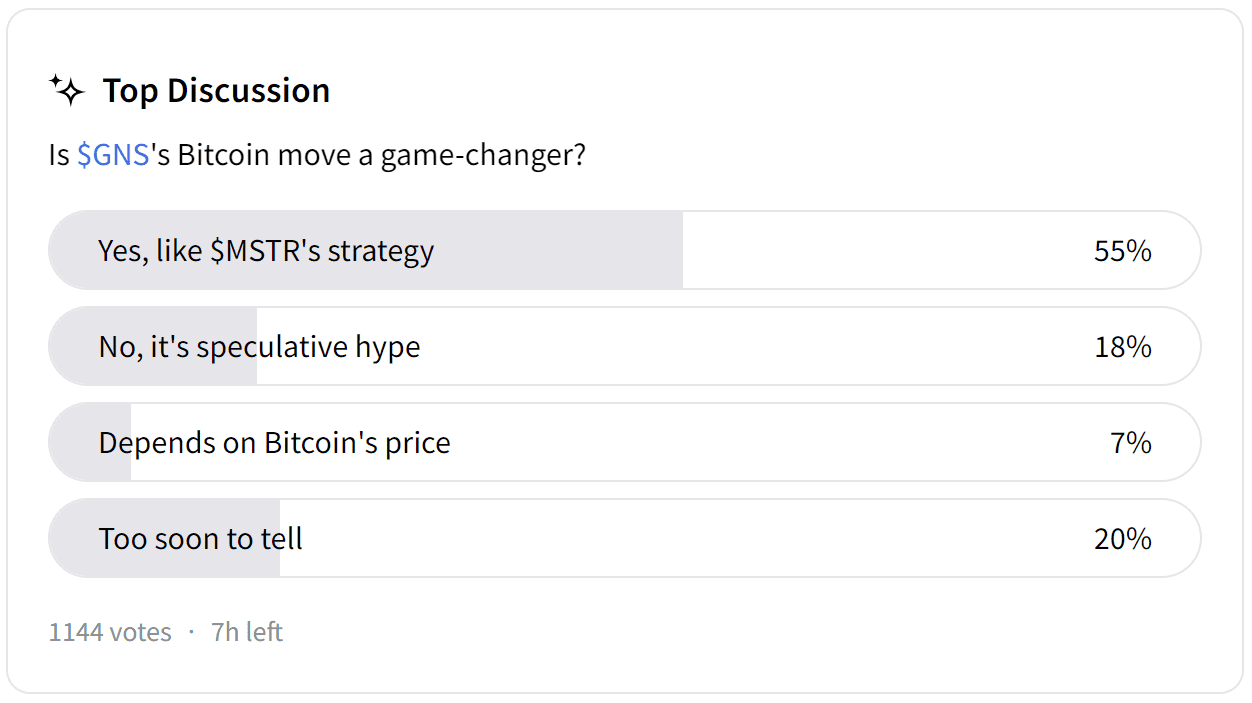

Retail investors on Stocktwits are optimistic about Genius Group’s pivot and hope to see the same returns as MicroStrategy after the latter pivoted to a Bitcoin-first strategy in 2020.

MicroStrategy’s stock has seen a massive gain of 446% so far in 2024 on the back of Bitcoin hitting a record high of nearly $90,000 this year.

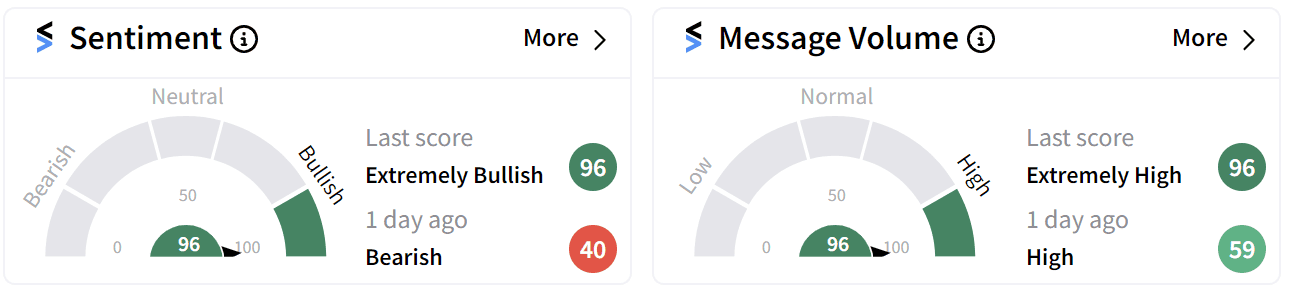

Retail sentiment around Genius Group’s stock has flipped to ‘extremely bullish’ from ‘bearish’ a day ago on news of the company’s new Bitcoin strategy.

Beyond Bitcoin, Genius Group is also advancing its Web3 initiatives, launching its "Web3 Wealth Renaissance" education series to teach students about Bitcoin, blockchain, and cryptocurrency fundamentals.

The company also plans to integrate Bitcoin payments into its education platform to provide a more crypto-friendly experience for users.

This shift in strategy comes as Genius Group continues its legal battle against market manipulators. The company has accused short-sellers of illegally selling securities without delivering them, a practice that has reportedly led to significant declines in its stock price.

CEO Roger Hamilton is leading these efforts, supported by a task force that includes a former Deputy Director of the FBI.

Genius Group's embrace of decentralized technologies is viewed by many as an attempt to reset its share price, a move Hamilton believes will unlock greater value for shareholders.

"Every step we take to embrace transparent, blockchain-based technology is an opportunity to reset Genius Group's share price commensurate with its value," Hamilton said in a statement.

Despite the surge, the stock has lost nearly 83% of its value so far in 2024.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202902434_jpg_34a840ada1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_CZ_ZHAO_OG_2_jpg_f6124171e0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248471134_jpg_9957fc576c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tandem_diabetes_resized_jpg_5f199c73c6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_82880353_jpg_0f9b1c5046.webp)