Advertisement|Remove ads.

MCX Hits Record High: SEBI RA Palak Jain Sees 50% Upside In Next Three Months

Shares of commodity exchange player Multi Commodity Exchange of India (MCX) surged 6% on Wednesday to hit a record high. This comes after global brokerage UBS raised its target price to ₹10,000, indicating 21% upside, driven by strong financials and new product launches.

The regulatory approval for electricity derivatives is expected to unlock fresh hedging tools. MCX reported a 54.2% profit increase in Q4 FY25, beating expectations.

MCX shares have rallied 33% in the last one month.

SEBI-registered analyst Palak Jain predicts further upside potential, with targets set at ₹11,145.34 to ₹12,829.92 in the next three months.

She observed that the stock has broken out above key resistance levels, triggering buying interest. Jain pegged support between ₹8,200-₹8,300, with resistance at ₹9,000-₹9,200.

She concludes that a bullish trend is expected, and investors are advised to monitor the stock closely.

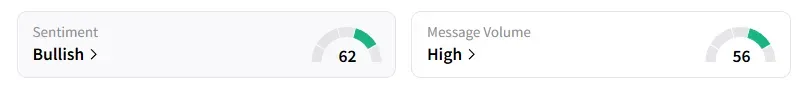

Data on Stocktwits shows that retail sentiment has turned ‘bullish’ on this counter this week.

Year-to-date, MCX shares have gained 38%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)