Advertisement|Remove ads.

Merck Reportedly Scraps Research Centre In UK: Retail Sees Stock Rallying To $97.50

Merck (MRK) has reportedly scrapped a £1 billion ($1.35 billion) London research centre and intends to lay off over 100 scientific staff in the U.K.

The Financial Times reported on Wednesday that the drugmaker scrapped the research centre in King’s Cross, which was due to open in 2027, and instead would move research activity to existing sites, predominantly in the U.S. The company committed to the research centre focused on neuroscience, inflammation, and immunology in King’s Cross in 2017, and construction commenced in 2023, FT said.

Merck would also lay off 125 scientists and support staff who had been working on early discovery efforts at the Francis Crick Institute and the London Bioscience Innovation Centre, according to the report.

However, the company will continue to run clinical trials in the country and will have about 1,600 staff working on these development programs and other areas, the report said. Merck told FT in a statement that the U.K. is “not internationally competitive.”

The decision comes on the heels of a battle between drug makers and the U.K. Health Secretary Wes Streeting on medicine prices. However, Merck told FT that its decision to scrap the London research centre was not related to the drug-pricing negotiations with the government.

The company, however, stated that the U.K. would lag behind its European peers in the share of the health budget allocated to drugs unless it improved its ability to attract and retain investment, according to the FT.

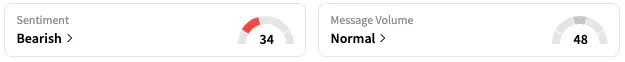

On Stocktwits, retail sentiment around MRK stock fell from ‘neutral’ to ‘bearish’ territory over the past 24 hours, while message volume stayed at ‘normal’ levels.

A Stocktwits user expects the stock to reach $97.50, implying a reasonable upside from its current trading levels.

Meanwhile, in the United States, Merck faces a September-end deadline to reduce the cost of its medicines as Trump pushes drugmakers to lower the cost of drugs in the U.S. to the levels paid by other developed nations.

According to data from Koyfin, 15 of the 37 analysts covering Merck rate it ‘Buy’ or higher, while 12 rate it ‘Hold’. The average price target for the stock is $102.33, representing an upside of over 22%.

MRK stock is down by 16% this year and by 27% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_moonlake_jpg_376bc698df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vlad_tenev_robinhood_CEO_OG_jpg_bf3a4c4bee.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Deere_resized_a913c16f0a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_b2gold_jpg_2d344842dd.webp)