Advertisement|Remove ads.

Merck Stock In Focus After Firm Announces Positive Results From RSV Antibody Trial: Retail’s Exuberant

Shares of Merck & Co Inc ($MRK) were in focus on Friday after the company presented positive results from its phase 2b/3 clinical trial evaluating clesrovimab, the firm’s investigational prophylactic monoclonal antibody designed to protect infants from respiratory syncytial virus (RSV) disease.

Merck said the incidence of adverse events (AEs) and serious AEs were comparable between the clesrovimab and placebo groups, and there were no treatment or RSV-related deaths during the study.

Chair of the Department of Infectious Diseases at St. Jude’s Children’s Research Hospital Octavio Ramilo said RSV continues to be a widespread seasonal infection that can affect both healthy and at-risk infants and is the leading cause of hospitalization for infants.

“These promising results demonstrating decreased incidence of RSV disease, including hospitalizations, highlight the potential for clesrovimab to play an important role in helping to alleviate the continued burden of RSV on infants and their families,” Ramilo said.

At the same time, the company also announced data from a planned interim analysis of a Phase 3 trial evaluating the safety and efficacy of clesrovimab versus palivizumab in infants and children at increased risk for severe RSV disease.

The interim results showed clesrovimab had a comparable safety profile to palivizumab, and no drug-related serious AEs were reported to date, the firm said.

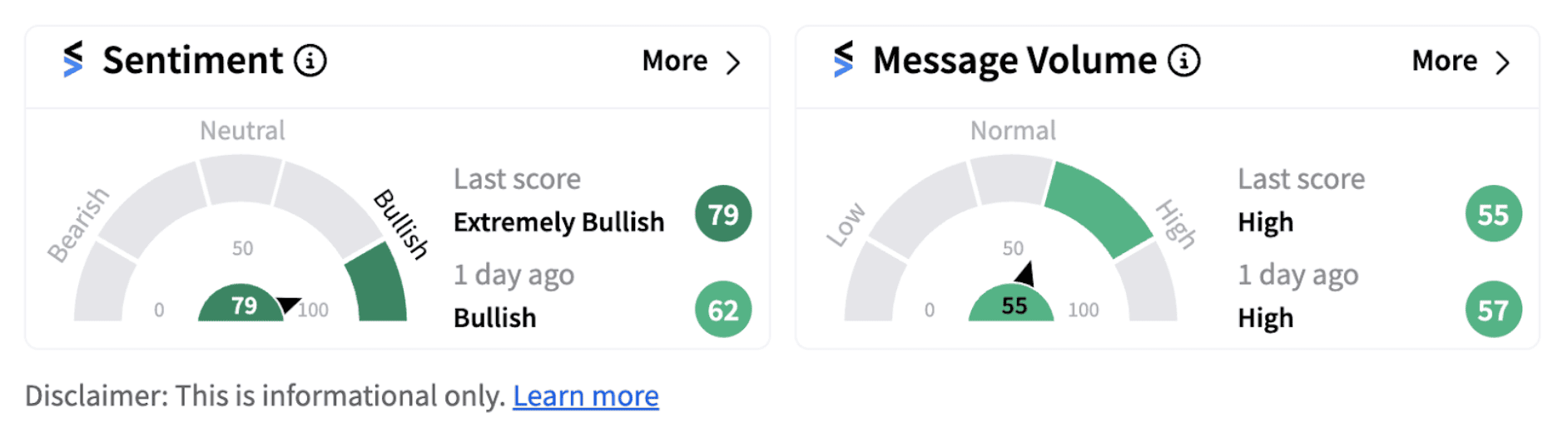

Following the announcements, retail sentiment on Stocktwits inched up into the ‘extremely bullish’ territory (79/100) from ‘bullish’ a day ago, accompanied by high retail chatter.

Recently, Bernstein initiated coverage of Merck with a ‘Market Perform’ rating and $115 price target, implying a 5% upside from the stock’s current level.

Notably, Merck shares have lost over 3% on a year-to-date basis, significantly underperforming the benchmark US indices.

Also See: Sobr Safe Stock Rockets 121% Premarket After Firm Withdraws Contemplated Public Offering

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)