Advertisement|Remove ads.

Meta Stock Slips Into The Red YTD, But Analyst Sees SMB Ad Boom — Retail Eyes The Dip

Meta Platforms, Inc. (META) stock slumped 3.73% on Tuesday as investors reacted to the tech-led broader market weakness and a downward price target adjustment by KeyBanc analysts.

However, a separate report from Morgan Stanely showed that the Mark Zuckerberg-led company remains the leader in the small and medium business (SMB) advertising market, thanks to core Facebook adoption, Instagram growth and early Meta Business Messaging signal.

Analyst Brian Nowak said core Facebook remained the most used platform by SMB advertisers, supported by industry-leading return on advertising spend (ROAS). This is despite the ROAS falling year over year (YoY) due to rising pricing.

The analyst noted that Instagram saw an increase in advertiser adoption, with 64% using the platform in 2024, up from 42% in 2023. Ten percent of advertisers said Instagram provided the highest return on investment (ROI), up from 5% in 2023, he added.

According to Nowak, the strength is attributable to Meta’s suite of graphic processing units (GPU)/Generative Artificial Intelligence (GenAI)-enabled tools it deploys across its platforms.

On Alphabet, Inc. (GOOGL) (GOOG), Nowak said Search and YouTube showed strong YoY adoption. He also noted that the Google suite of ad products across Search, YouTube and Maps saw big increases in net spending intent in 2025 versus last year.

Morgan Stanely said Alphabet’s PMax and Meta’s Advantage+ adoption signals were strong, with GenAI use cases expected to expand in 2025.

KeyBanc’s price target reduction on Tuesday was premised on the firm lowering its valuation multiples for advertising and real-estate stocks to reflect the greater macro uncertainty. The firm reduced its Meta stock price target to $710 from $750.

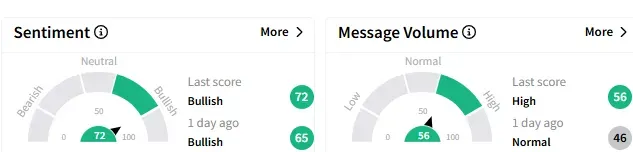

On Stocktwits, sentiment toward Meta stock stayed ‘bullish’ (72/100) with the message volume improving to ‘high’ levels.

A bullish watcher recommended buying the dip in the stock.

Meta stock ended Tuesday’s session down 3.73% at $582.36 and fell an incremental 0.19% in the after-hours session. The stock is down about 0.5% for the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)