Advertisement|Remove ads.

Meta Reportedly Stands Firm On EU Ad Model Amid Looming Regulatory Penalties

Meta Platforms Inc.(META) is reportedly on track to face fresh regulatory action from the European Union (EU) as it stands firm on its contentious advertising model, despite mounting legal pressure from EU watchdogs.

According to a Reuters report, the tech giant, known for its ownership of Facebook and Instagram, is unlikely to introduce further modifications to its ‘pay-or-consent’ approach for European users despite the European Commission threatening daily fines for failing to comply.

Meta Platforms' stock traded 1.7% lower on Friday morning, following the report, amid broader market weakness.

The report suggested that Meta has no plans to make additional changes unless EU authorities shift their stance. If the company maintains this position, it may be hit with fresh legal action and daily penalties reaching 5% of its average worldwide daily earnings.

The model offers users a choice between subscribing to a service without tracking or agreeing to the use of their personal data for targeted advertising.

Regulators fined Meta €200 million (approximately $234 million) in April, stating that the company's user consent framework violated the Digital Markets Act (DMA) between November 2023 and November 2024. Meta appealed the fine, prompting two months of negotiations, but the EU ultimately ruled its payment model violates the EU regulations.

The European Commission identified two main issues with Meta’s model. It fails to provide a truly equivalent free option, and user consent is pressured, as refusing consent forces users to pay a fee, creating a power imbalance.

In a statement in June, Meta asserted that its existing framework aligns with the requirements of the DMA. It also expressed confidence that the options provided to users in the EU not only meet but also exceed the regulatory standards.

This regulatory standoff comes at a time of broader scrutiny of Big Tech across Europe, with companies like Alphabet Inc. (GOOGL) and Apple Inc. (AAPL) also under investigation for compliance with DMA rules.

On Wednesday, Google acknowledged that it has not overcome objections from European hotels, airlines, and niche search service providers, following unsuccessful efforts to resolve disputes regarding how its search results are presented.

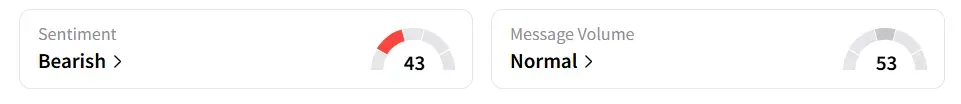

On Stocktwits, retail sentiment around Meta Platforms remained in ‘bearish’ territory.

Meta Platforms stock has added 22% year-to-date and over 39% in the last 12 months.

Also See: MicroCloud Bets Big On Crypto With $200M Bitcoin Investment: Retail’s Exuberant Amid Stock Surge

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Exchange Rate: 1EUR = 1.17USD

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)