Advertisement|Remove ads.

AT&T CEO Touts Strongest Broadband Growth In 8 Years: Retail Joins The Party

- The company’s Q3 revenue hit $30.7 billion while earnings per share (EPS) met analyst expectations.

- AT&T logged 288,000 new fiber customers and 270,000 new “Internet Air” customers.

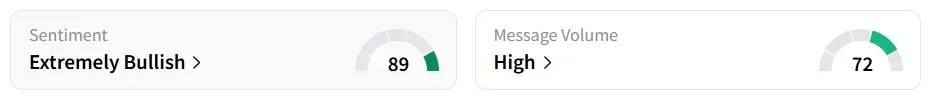

- Retail investor sentiment surrounding the stock turned 'extremely bullish' on Stocktwits.

AT&T Inc.(T) Chairman and CEO, John Stankey, said on Wednesday that the company delivered a strong performance in the third quarter (Q3) of 2025, showcasing strength in both its wireless and fiber broadband operations.

"We achieved our highest total broadband net adds in 8 years”.

- John Stankey, Chairman And CEO, AT&T

"In Mobility, we delivered over 400,000 postpaid phone net adds in the quarter, which is slightly ahead of our performance a year ago," Stankey added in the earnings call.

Revenue And EPS

The company recorded a revenue of $30.7 billion, marking a 1.6% year-on-year (YoY) increase, while adjusted earnings per share (EPS) stood at $0.54. While Q3 revenue slightly missed the analysts’ consensus estimate of $30.8 billion, EPS matched the estimate, according to Fiscal AI data.

Operating income reached $6.1 billion, marking a 190% jump YoY, and free cash flow increased to $4.9 billion from $4.6 billion last year.

AT&T stock traded over 2% lower on Wednesday afternoon. On Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ from ‘bullish’ territory the previous day. Message volume shifted to ‘high’ from ‘normal’ levels in 24 hours.

The stock experienced a 257% increase in user messages as of Wednesday morning.

Strong Customer Additions

The company added 405,000 post‑paid phone subscribers during the quarter while maintaining postpaid phone churn at 0.92%. On the broadband front, it logged 288,000 new fiber customers and 270,000 new “Internet Air” customers.

Led by these gains, consumer fiber broadband revenue advanced 16.8% YoY to $2.2 billion. Notably, over 41% of AT&T Fiber households also subscribe to AT&T Mobility service.

AT&T stock has gained over 11% year-to-date and over 18% in the last 12 months.

Also See: Intuitive Surgical Earnings Spark Analysts' Price Target Hike On Wall Street– Retail Optimism Jumps

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_xi_jinping_jpg_f2aa8420ba.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2219995127_jpg_47fff50a9f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244386520_1_jpg_e364bca397.webp)