Advertisement|Remove ads.

Amazon Stock Ticks Lower Premarket: Retail Traders Wary After AWS Outage Slightly Dents Cloud Credibility

- Amazon Cloud Services’ outage on Monday drew a mixed reaction for the stock; shares rose, but the retail sentiment remained ‘bearish.’

- Technical issues at AWS’s Virginia data center cluster affected hundreds of AWS customers, disrupting business for 15 hours for some.

- The incident might dent AWS’s credibility and boost business at rivals Google Cloud and Microsoft’s Azure.

Amazon.com’s stock drew mixed reactions from wary retail traders amid a slight dip in early premarket trading on Wednesday, following a major outage at its cloud computing arm, Amazon Web Services, which took down dozens of online sites and services at the start of the week.

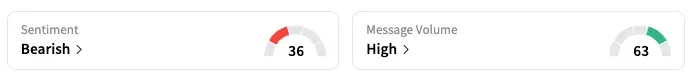

The stock rose 4.2% over Monday and Tuesday, while the retail sentiment remained in the ‘bearish’ zone as of early Wednesday, although it improved from a day earlier.

Technical problems at AWS’s Virginia data center cluster, known as US-EAST-1, caused the outage that lasted 15 hours and disrupted the operations of hundreds of companies, ranging from Apple to McDonald’s to Epic Games. Major services like Gmail, YouTube, and Instagram were down at various times during the day, while some others recovered only by Tuesday.

The incident follows a 2021 outage that originated from the same AWS cluster and is reminiscent of the CrowdStrike outage in July 2024, which brought banks, airports, and various daily activities that relied on computers to a standstill.

Amazon will likely have to compensate its cloud customers for losing business, a clause typically stated in the service contracts, but the bigger concern is the loss of credibility.

Amazon, which started the concept of renting cloud computing infrastructure and is currently the biggest player in the market globally, has for years prided itself on the reliability of its systems. Companies’ operations and their web applications – the core of their business – run on round-the-clock cloud services, and even a small blip can cause millions of dollars in lost revenue.

The latest AWS outage could increase the appeal of rival services, such as Google Cloud and Microsoft’s Azure, which are already seen to be a tad faster than AWS in incorporating AI-powered features.

Amazon has also been under the scanner for the AWS growth rate, which has fallen behind rivals in recent quarters. The company could share more details on the outage and its impact on the business at its quarterly report on Oct. 30.

Although a major share reaction is not expected this week, retail investor comments on Stocktwits were divided between calls to load up the stock given the company’s pole position in its businesses and the stock’s underperformance.

Amazon shares are up 1.2% year-to-date as of their last close.

Editor’s note: A previous version of this article incorrectly stated that the CrowdStrike outage occurred in October 2024. It actually took place in July 2024. The error has been corrected.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitdeer_OG_jpg_8f9fd0249d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rolls_royce_jpg_07109534ba.webp)