Advertisement|Remove ads.

Madrigal Pharma Stock Soars Despite Novo Nordisk’s ‘Superior’ MASH Trial Results: Retail Bullish On Earnings Beat

Companies developing therapies for metabolic steatohepatitis (MASH) saw strong gains even as Novo Nordisk ($NVO) announced that its GLP-1 drug, semaglutide, demonstrated “superior improvement” in treating the liver disease in its phase 3 ESSENCE trial.

Shares of Madrigal Pharmaceuticals ($MDGL), which received FDA approval earlier this year for its MASH drug, Rezdiffra, rose by 18% following the announcement, with 89Bio ($ETNB) and Akero Therapeutics ($AKRO) seeing gains of 15% and 4%, respectively.

Novo Nordisk’s ESSENCE trial, a 240-week, double-blind study involving 1,200 adults with MASH and moderate to advanced liver fibrosis, achieved its primary endpoints.

After 72 weeks, patients receiving a weekly dose of 2.4 mg semaglutide showed significant liver fibrosis improvement without worsening steatohepatitis, as well as steatohepatitis resolution with no worsening of liver fibrosis, compared to those on placebo.

"We are very pleased about the ESSENCE clinical trial results and the potential of semaglutide to help people living with MASH. Among people with overweight or obesity, one in three live with MASH. This has a serious impact on their health and represents a significant unmet need," said Martin Holst Lange, Novo’s executive vice president.

The FDA has yet to approve GLP-1 drugs for MASH, though several early trials have shown promise in reversing the disease’s initial stages.

In March, Madrigal’s Rezdiffra became the first FDA-approved treatment for MASH with moderate to advanced liver scarring.

On Thursday, Madrigal reported robust quarterly earnings, driven by Rezdiffra sales, which led to raised price targets and positive analyst notes.

Canaccord boosted its target on Madrigal to $394, citing confidence in continued revenue growth, while UBS increased its target to $441, highlighting an “underappreciated opportunity” in MASH and potential validation from Novo’s findings.

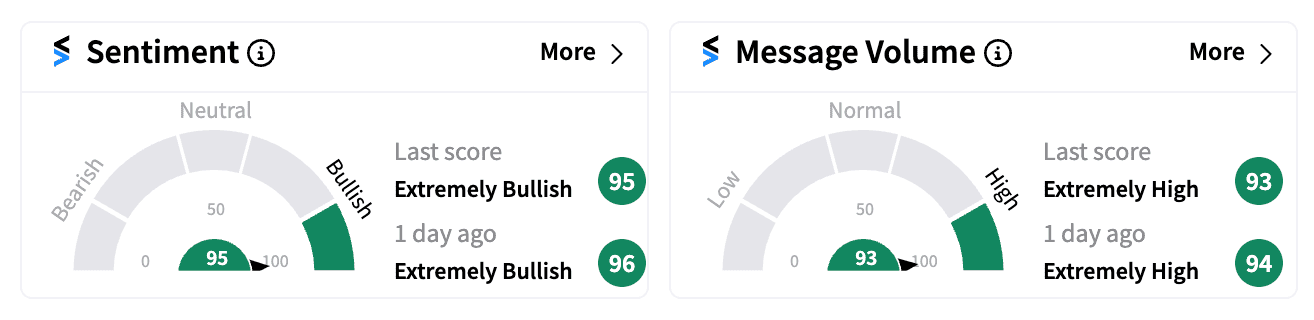

On Stocktwits, retail sentiment for MDGL remained ‘extremely bullish’ as of Friday afternoon amid a spike in message volume, with many fixated on Thursday’s strong results.

Some were also penciling in the next resistance levels for the stock that broke out over $300 this week.

Madrigal’s stock has surged over 33% year-to-date, significantly outperforming broader market benchmarks.

For updates and corrections, email newsroom@stocktwits.com

Read next: Essa Pharma Stock Crashes After Lead Drug Candidate Trial Flops: Retail Hopes Fade

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rare_earth_july_d867df7d47.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Intuit_resized_jpg_913ef93c15.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vir_biotech_jpg_f43ff73654.webp)