Advertisement|Remove ads.

What Is The CBOE Volatility Index And How Does It Work?

- Earlier in 2025, the VIX Index reached its highest daily close since the COVID-19 pandemic at 52.33 on April 8 after U.S. President Donald Trump launched his ‘Liberation Day’ tariffs.

- Several traders, institutional investors, and hedge fund managers often allocate capital to VIX-linked securities to diversify their portfolios.

- Those interested in investing in VIX can do so through futures or options contracts, or through VIX-based exchange-traded products.

The CBOE Volatility Index (VIX), also known as Wall Street’s Fear Index, is one of the most widely followed tools used by investors to assess market risk.

Created by the Chicago Board Options Exchange (CBOE) in 1993, VIX became the first benchmark to present volatility to Wall Street investors in the way they likely prefer: numbers and charts.

What Is The CBOE Volatility Formula? (CBOE Calculator)

According to CBOE, the VIX Index measures the 30-day expected volatility of the S&P 500 Index (SPX). The components of the VIX Index are put and call options with expirations of more than 23 days and less than 37 days. These include SPX options expiring on the third Friday of each month and weekly SPX options expiring every Friday.

The VIX is calculated by averaging the weighted prices of various SPX puts and calls across several strike prices. The present calculation method was developed in 2003 when CBOE collaborated with Goldman Sachs to update the methodology.

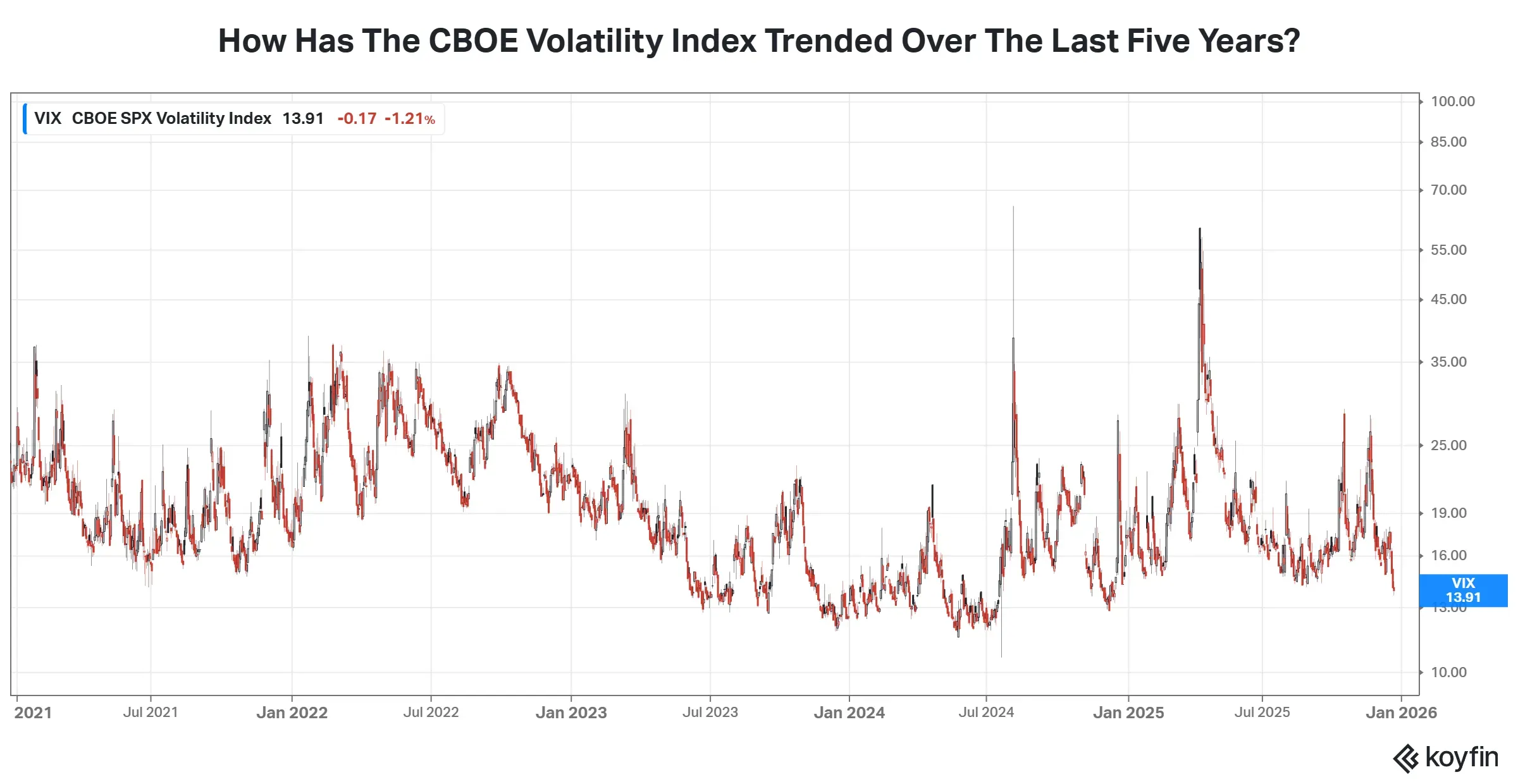

CBOE Volatility Index Chart

Historically, the VIX has shown sharp spikes during periods of market stress, such as financial crises, geopolitical shocks, and unexpected macroeconomic events. Elevated VIX levels typically coincide with heavy equity selling and increased demand for downside protection through options.

How Does CBOE Compare To The S&P 500?

The S&P 500 and the volatility index tend to move inversely. If the market goes down, the VIX usually rises; when stock prices rise, the VIX usually falls. When the VIX rises above 30, it is considered a sign of heightened uncertainty, risk, and investor concern. When the VIX falls below 20, it indicates a relatively stable market environment.

Earlier in 2025, the VIX Index reached its highest daily close since the COVID-19 pandemic at 52.33 on April 8 after U.S. President Donald Trump launched his ‘Liberation Day’ tariffs, which upended the markets. However, by May, it quickly fell below 20 as trade uncertainties eased and risk appetite improved.

How Can An Investor Trade The VIX?

Like the S&P 500 and other major indexes, investors cannot trade the VIX directly. Those interested in trading VIX can do so through futures or options contracts, or through VIX-based exchange-traded products (ETPs), like the ProShares VIX Short-Term Futures ETF (VIXY) and the iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX).

Several traders, institutional investors, and hedge fund managers often allocate capital to VIX-linked securities to diversify their portfolios. While the VIX measures only S&P 500 volatility, it is commonly used as a benchmark for the entire U.S. stock market, according to IG analysts. With rising macroeconomic uncertainties, the VIX will likely remain a crucial barometer of market stress.

Also See: Top 5 US Healthcare Stocks By Market Value

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_Social_logo_1200_Px_resized_jpg_86883cac04.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243387433_jpg_9712a99e81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227049575_jpg_fe5b82901f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_AI_OG_jpg_872671f607.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)