Advertisement|Remove ads.

Michael Burry Cautiously Ups Alibaba, JD.com, Baidu Bets With Offsetting Hedges: Retail Doesn’t Share Big Short Investor’s Optimism

Big short fame Michael Burry-run Scion Asset Management’s September quarter 13F report filed late Thursday showed increased exposure to its China stock holdings Alibaba Group Holding Ltd. ($BABA), Baidu, Inc. ($BIDU) and JD.com. Inc. ($JD). The hedge-fund manager, however, covered much of his positions in these stocks with put options.

Burry is known for accurately predicting the 2007 subprime mortgage crisis that later morphed into the global financial crisis.

At the end of the third quarter, Scion held 200,000 Alibaba ADRs valued at $21.22 million, up from 155,000 ADRs worth $11.16 million at the end of the second quarter.

He hedged his Alibaba bet by buying put options on 168,900 ADRs. This strategy insulates him against any potential drop in Alibaba shares.

Alibaba shares have rebounded nicely this year amid China’s concerted efforts to stimulate domestic growth. The e-commerce giant is scheduled to report its second-quarter results before the market opens on Friday.

Burry’s firm increased its Baidu holding from 75,000 ADRs, valued at $6.49 million, to 125,000 ADRs worth $13.16 million. It also bought put options on 83,000 Baidu ADRs.

The firm loaded up ADRs of Alibaba’s peer JD, increasing its stake in the company from 250,000 ADRs to 500,000 ADRs. The value of JD,com holdings swelled from $6.46 million to $20 million. Bury also bought puts on JD.com for 500,000 in underlying shares.

On the other hand, Burry halved RealReal, Inc. ($REAL) holdings from 1 million shares to 500,00 shares. It also significantly cut its stake in American Coastal Insurance Corporation ($ACIC) from 251,892 to 100,000.

Scion fully cashed out of oncology-focused biotech BioAtla, Inc. ($BCAB) and office real estate investment trust Hudson Pacific Properties, Inc. ($HPP).

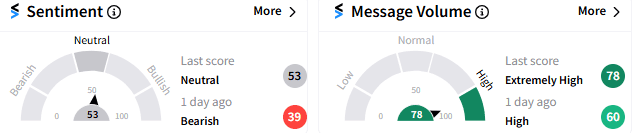

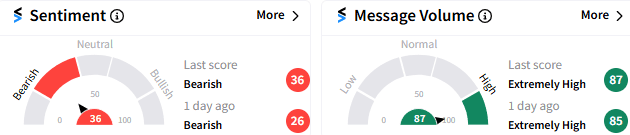

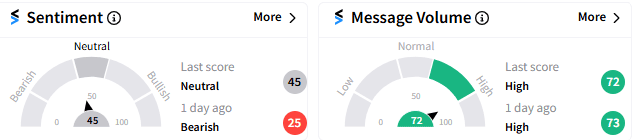

On Stocktwits, sentiment towards Burry’s China holdings is muted.

Sentiment toward Alibaba was 'neutral' on Stocktwits platform, although improving from a 'bearish' stance a day ago.

JD.com elicited 'bearish sentiment' (36/100) from the retail, although message activity remained 'extremely high,' possibly due to the earnings report released Thursday.

Baidu did not fare any better, with the retail mood 'bearish' (45/100) on Stocktwits, although message volume, a proxy for activity, was 'high.'

As of 4:06 am ET, Alibaba shares eased 0.63% to $90.01, while JD.com climbed 1.83% to $33.96 and Baidu gained 1.18% to $85.05.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)