Advertisement|Remove ads.

Micron Eyes Best Day In 8 Months As Wall Street Floods Stock With Bullish Calls — ‘AI Supercycle Has Come To Memory’

- Analysts across Wall Street raised Micron price targets after results and guidance beat expectations.

- AI-led demand, strong pricing, and margin expansion drove the bullish revisions.

- Supply tightness and visibility in HBM and DRAM memory chips supported longer-term outlooks.

Micron Technology (MU) shares are poised to log their strongest session in over eight months on Thursday after a broad wave of Wall Street analysts raised price targets following quarterly results and guidance that exceeded expectations, driven by AI-led memory demand, pricing strength, and margin expansion.

At the time of writing, the stock jumped over 12% to $252.71

Wall Street Delivers Broad Price Target Hikes

Wolfe Research raised its price target to $350 from $300 and reiterated an ‘Outperform’ rating. Deutsche Bank lifted its target to $300 from $280 and kept a ‘Buy’ rating, calling the quarter and outlook “another stunning” performance and pointing to a “paradigm shift in the memory sector.”

TD Cowen increased its target to $300 from $275 and maintained a ‘Buy’ rating, noting that with margins approaching 70%, “the question is no longer how much MU can earn.” Baird sharply raised its target to $443 from $235 and reiterated an ‘Outperform’ rating, citing “significant stock upside left” even assuming a mid-2027 peak.

Guidance Strength Drives Bullish Revisions

Cantor Fitzgerald raised its target to $350 from $300 and kept an ‘Overweight’ rating, citing February-quarter guidance exceeding consensus by $4.4 billion and continued supply constraints through 2026. Rosenblatt lifted its target to $500 from $300 and reiterated a ‘Buy’ rating, pointing to record gross margins of 68% and demand expected to outstrip supply into 2027.

Goldman Sachs raised its target to $235 from $205 while maintaining a ‘Neutral’ rating, citing rising contract prices across HBM, DRAM, and NAND memory chips, alongside constrained cleanroom capacity.

AI Demand Rewrites the Memory Cycle

UBS lifted its target to $300 from $295 and reiterated a ‘Buy’ rating, highlighting upside to earnings estimates approaching $40 per share. Morgan Stanley raised its target to $350 from $338 and kept an ‘Overweight’ rating, saying “clearly we underestimated,” adding, “as long as the AI music plays, we believe this is going to keep happening.”

Citi increased its target to $330 from $300 and reiterated a ‘Buy’ rating, stating that the “AI supercycle has come to memory.”

Supply Constraints Extend the Upside

JPMorgan raised its target to $350 from $220 and maintained an ‘Overweight’ rating, saying guidance implies February-quarter revenue more than doubling year-over-year. Wells Fargo lifted its target to $335 from $300 and reiterated an ‘Overweight’ rating, citing demand exceeding supply beyond 2026.

Piper Sandler raised its target to $275 from $200 and kept an ‘Overweight’ rating, describing the outlook as “exceptional” and pointing to continued supply tightness through calendar 2026 and beyond.

Additional price target increases came from Raymond James, Mizuho, KeyBanc, Barclays, and Bank of America Securities (BofA), which upgraded Micron to ‘Buy’ from ‘Neutral’ and raised its target to $300 from $250, noting that HBM is sold out through calendar 2026 with customers engaged in multi-year agreements.

How Did Stocktwits Users React?

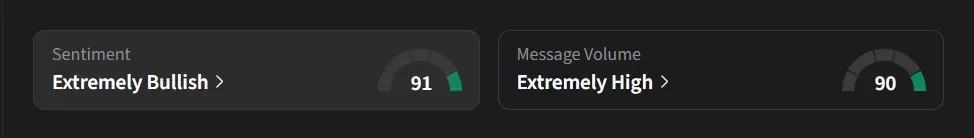

On Stocktwits, retail sentiment for Micron was ‘extremely bullish’ amid ‘extremely high’ message volume.

Micron’s stock has tripled so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219715394_jpg_c787a7b591.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_martin_shkreli_jpg_4da92d4843.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)