Advertisement|Remove ads.

Microsoft Analyst Says Software Giant Key Shelter In Macroeconomic Storm Buffeting Magnificent Six Peers: Retail Isn't Excited

Microsoft Corp. (MSFT) received a ratings upgrade and price target boost on Thursday, but the stock did not budge.

DA Davidson analyst Gil Luria upgraded Microsoft stock to ‘Buy’ from ‘Neutral’ and upped the price target to $450 from $425. The updated price target implies scope for nearly 18% upside from current levels.

Luria said the software giant has moved to a more rational capex strategy since DA Davidson downgraded the stock in September, citing the poor return on investment (ROI) of the escalating artificial intelligence (AI) infrastructure buildout as one of the reasons

Luria noted that since then, the company has guided to sequentially flat capital expenditure over the next couple of quarters.

The analyst said evidence now suggested that Microsoft was offloading less desirable capex to CoreWeave, Oracle, and Softbank. “Microsoft gets to maintain exclusivity for the desirable OpenAI ChatGPT inference workloads without fickle training workloads,” he added.

According to the DA Davidson analyst, Microsoft is the best-positioned Magnificent Six for a consumer slowdown, making it a key shelter in the storm. He noted that apart from Nvidia Corp. (NVDA), Microsoft has the least consumer exposure out of this elite grouping of stocks and that Nvidia had its fair share of woes.

The analyst foresees at least some slowdown in consumer spending. If the expectation materializes, Microsoft will likely face the least risk to its earnings estimates, he said.

On valuation, Luria said that following Microsoft stock’s underperformance compared to the other Magnificent Six peers over the past six months, it now properly reflected the drag from previous capital expenditure escalation.

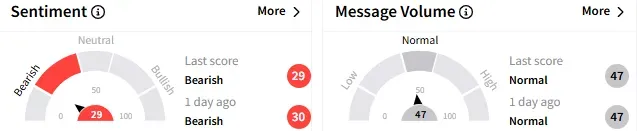

On Stocktwits, retail sentiment toward the stock stayed bearish (29/100), and the message volume remained ‘normal.’

Retail’s concerns about Microsoft stock mostly revolved around President Donald Trump’s tariffs. A bearish watcher said the stock will likely crash much lower.

Another user said the next stop on the downtrend is likely around the $300 level.

Microsoft stock slipped nearly a percent to $379.98 after declining over 9% for the year-to-date period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Archer Aviation, Palantir Announce Next-Gen Aircraft Software Development Pact: Retail’s Unimpressed

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)