Advertisement|Remove ads.

Moderna Surpassed Q2 Earnings Estimates: Here’s Why Retail Sentiment Is ‘Extremely Bearish’ And The Stock Is Down 17%

Shares of Moderna plunged nearly 17% during the pre-market session after the company trimmed its full-year forecast. It cited low EU sales in 2024, potential revenue deferrals for certain international sales into 2025, and an increasingly competitive environment for respiratory vaccines in the U.S.

Moderna now expects 2024 net product sales between $3.00 billion and $3.50 billion from its respiratory franchise compared to previous guidance of $4 billion.

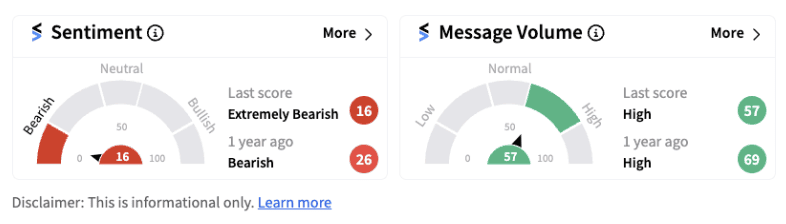

Following the announcement, retail sentiment dipped into ‘extremely bearish’ territory (16/100) souring further from yesterday’s ‘bearish’ reading.

On a positive note, the vaccine-maker reported an earnings loss of $3.33 during the second quarter versus an estimated loss of $3.39. Revenue came in at $241 million compared to a forecast of $132 million. Despite beating the analyst estimate, revenue declined 30% year-over-year (YoY) weighed down by decreased sales of the company's COVID-19 vaccine.

Stéphane Bancel, Chief Executive Officer of Moderna stated that the firm has significantly lowered its operating costs during the second quarter. “We remain focused on execution for the 2024-25 COVID season and the launch of our RSV vaccine in the U.S.,” he said.

Bancel stated the firm is involved in discussions with governments across Europe but some of them have pointed toward a tight budget restraining their capacity to buy more vaccines. The firm reportedly expects to see sales growth by 2025 and hit a breakeven position by 2026.

Retail investors aren’t happy with the full-year guidance trim and the company’s efforts on the Covid vaccine given that its demand remains uncertain. One Stocktwits user expressed his ‘bearish’ view by stating that Moderna lowered its already lowered guidance, a sign it still has work to do in sufficiently diversifying its revenue streams.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228875477_jpg_4c76a2e8b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213365850_jpg_470b9c6c06.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lithium_47e0215e10.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_evolent_jpg_3c3f2aa8e5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250655281_jpg_c8c0e9352f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)