Advertisement|Remove ads.

Mogo Stock More Than Doubles After $50M Bitcoin Treasury Strategy – Hits 3-Year High

Financial technology firm Mogo Inc. (MOGO) on Wednesday announced plans to allocate up to $50 million toward Bitcoin (BTC) as part of a broader strategy focused on innovation and capital efficiency.

Following the news, Mogo stock more than doubled in Wednesday’s premarket, reaching its highest level in nearly three years. The move aims to position the cryptocurrency as both a reserve asset and a benchmark for internal capital deployment.

Bitcoin’s price was also on the rise during early morning trade, gaining 0.8% in the last 24 hours to trade at around $107,400.

The decision, approved by the company’s board, marks a deeper integration of Bitcoin into Mogo’s operations and treasury policy.

After the anticipated closing of Robinhood’s acquisition of WonderFi in the latter half of 2025, Mogo plans to maintain approximately $50 million in available cash and assets.

The company intends to build its Bitcoin position over time, using surplus funds and returns from holdings in companies such as U.S. crypto exchange Gemini and Canadian software firm Hootsuite.

The Canadian fintech will now evaluate future capital decisions, including mergers and acquisitions activity, share buybacks, and internal projects, against the long-term returns of holding Bitcoin.

Mogo said it will distinguish itself from typical Bitcoin treasury companies by maintaining large-scale operations in lending, investment management, and payment services.

“We’re not just holding Bitcoin, we’re building a business we believe can scale to over a billion dollars in enterprise value,” said President & Co-Founder, Greg Feller.

Mogo aims to incorporate Bitcoin across its suite of services, reaching its nearly 2 million users in Canada. Within its wealth division, the company will launch a signature portfolio blending traditional equities with Bitcoin in a 60/40 split.

For lending, it is developing crypto-backed loan offerings that could reduce interest rates. In the payments space, Mogo said it's exploring the use of stablecoin technology to streamline and lower the cost of international transactions.

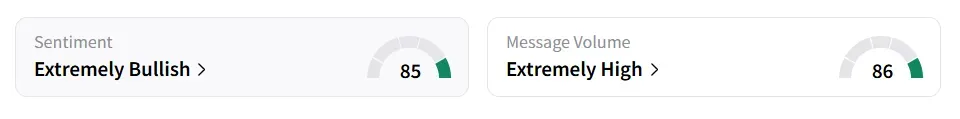

On Stocktwits, retail sentiment towards Mogo improved to ‘extremely bullish’(85/100) from ‘bearish’ the previous day. Message volume jumped to ‘extremely high’(86/100) from ‘low’ levels in 24 hours.

Mogo stock has lost 11% year-to-date and more than 19% over the last 12 months.

Also See: Baidu Reportedly Overhauling Flagship Search Engine Amid Slump In Ad Revenue

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860610_jpg_2888fdef75.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novo_nordisk_ozempic_wegovy_jpg_786cdf3b34.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Micron_jpg_7058d4986a.webp)