Advertisement|Remove ads.

No Monday Blues For Monday.com – Retail Cheers Solid Q2

Shares of cloud-based software platform Monday.com soared nearly 11% after the company reported its first quarter of operating profitability. The firm reported a 34% year-over-year (YoY) rise in its second-quarter revenue at $236.10 million, surpassing an analyst estimate of $229.09 million.

Diluted earnings per share (EPS) came in at $0.94 versus an estimate of $0.56. Net income stood at $14.32 million compared to a net loss of $7.04 million in the same quarter a year ago.

The firm also raised its full-year guidance and now expects total revenue of $956 million to $961 million, representing year-over-year growth of 31% to 32% versus a prior guidance of $942 million to $948 million.

Non-GAAP operating income is expected in the range of $100 million to $105 million with an operating margin of 10% to 11% — higher than an earlier guidance of $77 million to $83 million and operating margin of 8% to 9%.

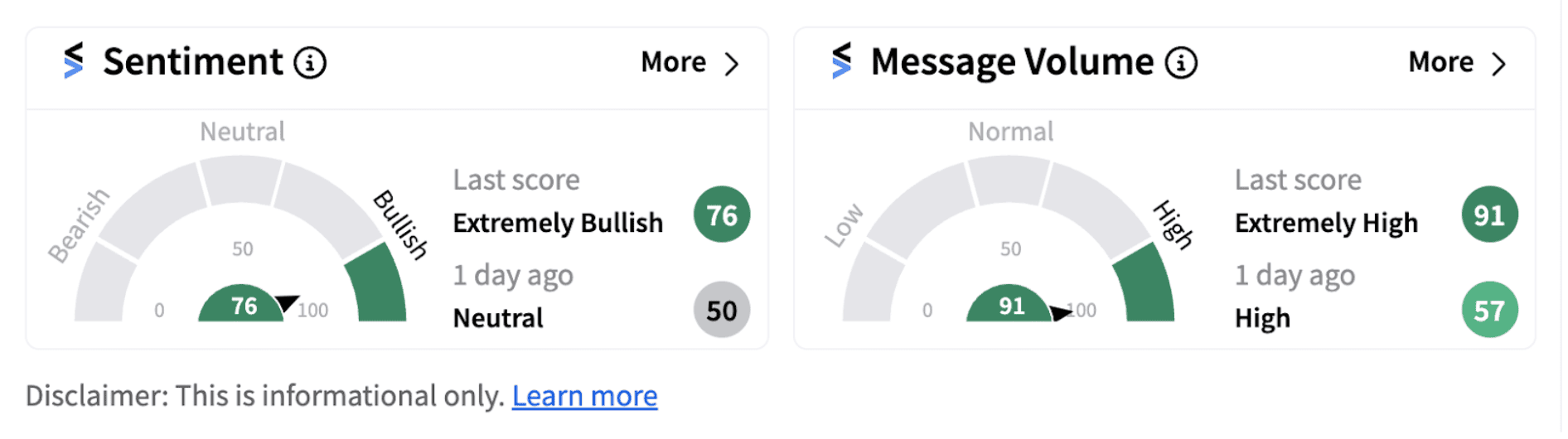

Following the announcement, retail sentiment flipped into the ‘extremely bullish’ territory (76/100) from the ‘neutral zone’ a day ago. The move was accompanied by ‘extremely high’ message volumes (91/100).

Monday.com also witnessed a significant growth in some of its critical metrics. For instance, the number of paid customers with more than $100,000 in ARR stood at 1,009, rising 49% from the same period last year. Similarly, the number of paid customers with more than $50,000 in ARR rose 43% YoY to 2,713.

The firm’s co-founders and co-CEOs, Roy Mann and Eran Zinman noted that the company continues to drive strong and efficient growth, while constantly innovating to ensure that its go-to-market strategy, products, and platform can effectively scale as customers grow. “In Q2, these ongoing investments enabled us to more than triple our largest seat count as we continue to focus on expanding upmarket,” they said.

Stocktwits users are expressing optimism that shares of the firm may nudge the $260-mark given the positive report.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347233_jpg_00e33be418.webp)