Advertisement|Remove ads.

Moody’s Stock Hits Record High On Upbeat Q4 Earnings, 2025 Guidance: Retail Excitement Shoots Through The Roof

Shares of Moody's Corp (MCO) hit a record high on Thursday after the company’s fourth-quarter earnings topped Wall Street estimates.

The company reported adjusted earnings per share (EPS) of $2.62 compared to a Street estimate of $2.58. Revenue rose 13% year-over-year (YoY) to $1.67 billion but fell short of an analyst estimate of $1.71 billion, according to FinChat data.

Net income rose 16% YoY to $395 million during the quarter.

Segment-wise, Moody’s Analytics (MA) revenue grew 8% YoY to $863 million, driven by 11% growth in Decision Solutions with notable contributions from Banking (11%), Insurance (9%) and Know Your Customer (15%).

Moody’s Investors Service (MIS) revenue rose 18% YoY to $809 million.

CFO Noémie Heuland said that for 2025, the company expects revenue growth in the high-single-digit percent range and adjusted diluted EPS in the range of $14.00 to $14.50, growing low-to-mid-teens on the back of 26% growth in full year 2024. Wall Street expects annual EPS at $13.59.

“Heading into the third year of our medium-term targets, we have assessed our performance and are excited to provide an update, including a raise of our adjusted diluted EPS growth rate to a range of low-to-mid-teens percent,” Heuland said.

Meanwhile, the Board of Directors declared a regular quarterly dividend of $0.94 per share, representing an 11% increase from the prior quarterly dividend of $0.85 per share.

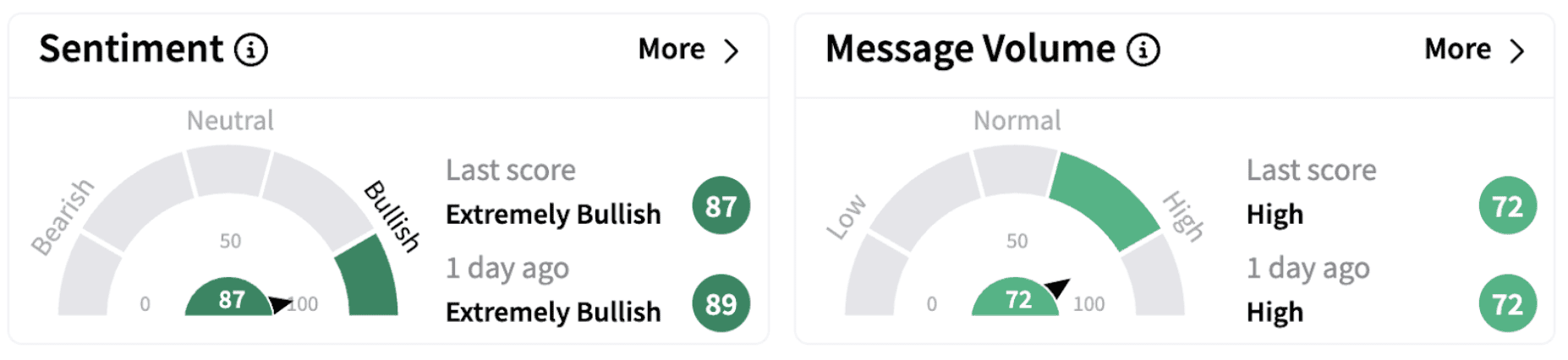

On Stocktwits, retail sentiment continued to trend in the ‘extremely bullish’ territory (87/100) accompanied by ‘high’ message volume.

One Stocktwits user expressed optimism about the company’s guidance.

Recently, BMO Capital raised the firm's price target on Moody's to $481 from $468 while keeping a ‘Market Perform’ rating on the shares, according to TheFly.

Moody’s shares have risen 9% in 2025 and have gained over 39% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1321753430_jpg_3be244e72e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740807_jpg_19c077b8cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_changpeng_zhao_binance_CEO_OG_jpg_1f2a158765.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)