Advertisement|Remove ads.

Why Is MoonLake Immunotherapeutics Stock Crashing Premarket?

MoonLake Immunotherapeutics’ shares plunged about 85% in early premarket trading on Monday after Wall Street analysts panned data from a late-stage trial of its skin drug, setting the stock up for its worst day on record.

The company reported 16-week results from its Phase 3 VELA-1 and VELA-2 trials of sonelokimab in patients with moderate-to-severe hidradenitis suppurativa (HS), also known as acne inversa — a chronic inflammatory condition characterized by painful, boil-like nodules that can rupture, drain pus, and leave scars.

In VELA-1, sonelokimab patients achieved a 17-percentage-point higher response rate versus placebo; in VELA-2, the gap was 9 points under the composite analysis. Using the treatment-policy approach, both trials showed statistically significant results: 35% and 36% for sonelokimab versus 18% and 26% for placebo.

The mixed data disappointed analysts. Stifel cut its rating to ‘Hold’ from ‘Buy’ and slashed its price target to $13 from $77, saying the results were “significantly worse than expected” and trimming its estimated probability of success for the HS indication to 33% from 75%.

RBC Capital also downgraded the stock to ‘Sector Perform’ from ‘Outperform’, and lowered its price target to $10 from $67, calling the results a “near-miss” statistically and warning the drug’s effect size looked uncompetitive.

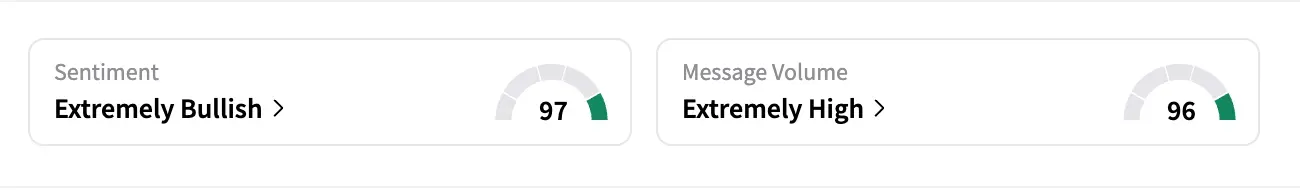

Retail traders on Stocktwits took the opposite view, driving sentiment for MLTX to ‘extremely bullish,’ and the mood is poised to hit the highest level of the year.

“These kind of monster plunges are a good chance to make an easy 20% trade. Again, despite a disaster, Sono looks approvable and psA is still on deck. Buyer at 7-8 at any time,” said one user.

“MLTX results are good everyone being melodramatic about placebo response in second study,” posted another.

As of Friday’s close, MoonLake shares were up more than 14% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260984359_jpg_566af2429c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Alphabet_jpg_b0657d669f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Brian_Armstrong_Coinbase_60d65adb96.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_moderna_logo_resized_c72083ff97.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237640344_jpg_bc97a7240c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245685477_jpg_ce08eb96cb.webp)