Advertisement|Remove ads.

Morgan Stanley Lifts Micron’s Price Target To ‘Street High’, Cites Soaring Chip Demand

- Morgan Stanley lifted its price target on Micron to $325 from $220.

- The firm cited mounting evidence that the company is entering a new era of record-breaking profitability.

- Analyst Joseph Moore expects DRAM prices to climb another 15% to 20% through the first half of 2026.

Micron Technology Inc. (MU) on Thursday received a boost from Morgan Stanley, as the firm lifted its price target on the stock to a ‘Street high’ of $325 from $220 and reaffirmed an ‘Overweight’ rating.

The new price target represents a 33% upside to the stock’s closing price as of Wednesday.

Record Growth In DRAM Market

Morgan Stanley analyst Joseph Moore called Micron his top stock pick, citing rising memory chip prices and mounting evidence that the company is entering a new era of record-breaking profitability, according to TheFly.

Moore noted that prices for DDR5 memory modules have surged by double digits in recent quarters. He likened the current environment to the 2018 DRAM cycle but emphasized one key difference: Micron’s earnings are already at record levels heading into this upswing, suggesting much higher potential peaks ahead.

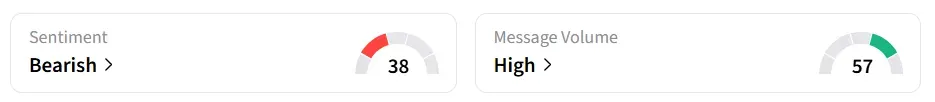

Micron’s stock inched 0.4% higher on Thursday morning. On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory amid ‘high’ message volume levels.

AI Demand Fuels Optimism

According to a CNBC report, Moore expects DRAM prices to climb another 15% to 20% through the first half of next year. However, buyers who failed to secure early contracts could end up paying 50% or more above benchmark prices, underscoring how constrained supply has become.

“We believe that’s going to move us firmly into uncharted territory from an earnings standpoint, and we think the stock has yet to fully price in the upside that’s coming.”

-Joseph Moore, Analyst, Morgan Stanley

Micron offers a wide range of fast, high-quality DRAM, NAND, and NOR memory and storage solutions under its Micron and Crucial brands.

MU stock has gained over 189% year-to-date and over 143% in the last 12 months.

Also See: Oppenheimer Sees Another Nvidia Earnings Beat, Hikes Price Target Before Q3 Results

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)