Advertisement|Remove ads.

Oppenheimer Sees Another Nvidia Earnings Beat, Hikes Price Target Before Q3 Results

- Oppenheimer has raised its price target for Nvidia to $265 from $225.

- Rick Schafer said the company continues to benefit from ‘structural tailwinds’ across sectors.

- According to Fiscal AI data, analysts expect Nvidia to post a Q3 revenue of $54.8 billion and earnings per share of $1.25.

Nvidia’s relentless run and growth story has prompted another show of confidence from Wall Street. Oppenheimer has raised its price target for Nvidia Corp. (NVDA) to $265 from $225, reiterating its ‘Outperform’ rating ahead of the chipmaker’s quarterly earnings on November 19.

The move signals growing confidence that Nvidia will surpass Wall Street’s revenue and profit expectations, driven by continued demand for its artificial intelligence hardware.

AI Momentum And Market Leadership

Oppenheimer expects Nvidia to post stronger-than-anticipated results for its fiscal third (Q3) and fourth quarters (Q4), forecasting sales and earnings per share above consensus estimates, according to TheFly.

The firm projects $54.7 billion in Q3 revenue and $61.5 billion in Q4, supported by the company’s new GB300 Ultra chips and ongoing capital spending by major cloud providers eager to expand their AI infrastructure.

According to a CNBC report, analyst Rick Schafer said the company continues to benefit from ‘structural tailwinds’ across gaming, data centers, and autonomous vehicles.

“Nvidia has transformed from a graphics company to a premier leading full stack AI solutions platform company.”

-Rick Schafer, Analyst, Oppenheimer

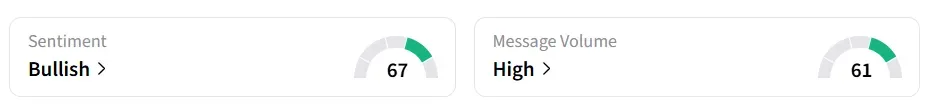

Nvidia’s stock traded over 1% lower on Thursday, aftre the morning bell. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘high’ message volume levels.

Growth Outlook And China Potential

During Nvidia’s recent GTC Developer Conference, CEO Jensen Huang predicted combined revenues from the company’s Blackwell and Rubin architectures could reach $500 billion by the end of fiscal 2026.

Schafer echoed this optimism, pointing to exponential growth drivers like reasoning and ‘agentic AI,’ which he believes are creating a self-reinforcing adoption cycle for Nvidia’s technology, according to the report.

While the firm’s projections exclude China for now, Oppenheimer estimates that the market could represent an additional $50 billion opportunity.

According to Fiscal AI data, analysts expect Nvidia to post a Q3 revenue of $54.8 billion and earnings per share (EPS) of $1.25.

NVDA stock has gained over 44% in 2025 and over 32% in the last 12 months.

Also See: UFC Teams With Polymarket To Launch Real-Time Fan Prediction Scoreboard

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)