Advertisement|Remove ads.

Morgan Stanley Says AMD’s Market Share Gain Is Key To Its AI Strategy

- Morgan Stanley reaffirmed its ‘Equal Weight’ rating on AMD stock and maintained a price target of $260.

- Goldman Sachs analyst James Schneider said the company’s growth story aligns with broader industry momentum.

- AMD stock rose over 7% on Wednesday, after the morning bell.

Morgan Stanley analyst Joseph Moore said that Advanced Micro Devices Inc. (AMD) delivered a clear and well-organized growth outlook during its latest investor day, which focused heavily on the growing influence of artificial intelligence across multiple sectors.

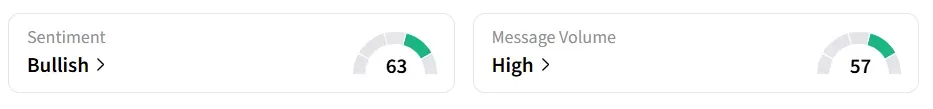

Moore described the event as ‘positive and well constructed,’ though he noted it contained ‘few surprises.’ AMD stock traded over 7% higher on Wednesday, after the morning bell. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘high’ message volume levels.

AI As Engine Of Expansion

The analyst noted that AMD projected a 35% compound annual growth rate (CAGR) in total revenue over the next three to five years, with AI identified as the company’s primary driver of expansion.

Moore said the long-term earnings model shared at the event appears largely in line with the firm’s current financial forecasts, but he added that AMD’s ability to gain market share with its MI350 data center chips will be a critical factor to watch, according to TheFly.

Morgan Stanley reaffirmed its ‘Equal Weight’ rating on AMD stock and maintained a price target of $260 per share.

AMD’s investor day underscored its plan to accelerate AI integration across its entire product portfolio, from data centers and PCs to embedded devices. The company aims to capture a larger share of the booming AI compute market.

Speaking to CNBC, CEO Lisa Su said, “Signals in the markets are saying that we are in the beginning of the technology”.

What Do Citi And Goldman Sachs Say?

Citi reaffirmed a ‘Neutral’ rating and maintained its $260 price target. Analysts at Citi noted that the company’s growth projections were largely in line with existing investor expectations.

The firm said the targets, while optimistic, reflect a continuation of AMD’s current strategy to expand its footprint in the high-performance computing and AI markets.

Goldman Sachs analyst James Schneider also highlighted AMD’s strong long-term goals, particularly its outlook for expanding data center GPU and CPU businesses amid rising AI adoption. He said the company’s growth story aligns with broader industry momentum.

AMD stock has gained over 96% in 2025 and over 65% in the last 12 months.

Also See: CMCT Stock More Than Doubles Pre-Market Today: Here’s Why

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)