Advertisement|Remove ads.

Moschip Shares Slip 5% After Strong Rally; SEBI Analyst Sees ₹300 Target

Moschip Technologies shares fell 5% on Thursday due to profit booking after the stock a rallied 12% in the past month.

The Hyderabad-based semiconductor company has shown strong financial growth, driven by rising demand for semiconductor solutions and the successful execution of projects, according to SEBI-registered analyst Pradeep Carpenter. While valuation and promoter holding trends warrant caution, the stock presents an opportunity for investors seeking exposure to India’s semiconductor sector.

It was among the top trending stocks on Stocktwits at the time of writing.

Technical Outlook

On the technical side, he said that Moschip stock had been consolidating around the ₹180 levels for a long time. In September 2025, it started a strong bull run and reached a high of ₹279. This rally was fueled by increased investor interest in India’s semiconductor sector, favorable government policies, and MosChip’s strong earnings growth and initiatives.

Carpenter said that the stock breaking above ₹260 signalled a potential continuation of the uptrend. Its Relative Strength Index (RSI) stood around 63, indicating bullish momentum without being overbought. Additionally, its short-term and long-term moving averages indicate a strong bullish trend.

He set a target of ₹300+ levels with a stop-loss at ₹240 (on a closing basis) for Moschip.

Carpenter, however, cautioned that its high price-to-earnings ratio of 125.5 may indicate overvaluation. Also, its promoter holding has declined over the past three years, which may signal lower insider confidence.

What Is The Retail Mood?

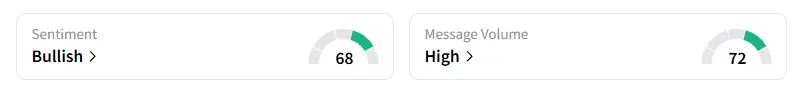

Data on Stocktwits shows retail sentiment has been ‘bullish’ for a week amid ‘high’ message volumes.

Moschip shares have risen 33% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256305566_jpg_26cd17b56a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_wall_street_sign_resized_f75f6c0a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_LUNR_Intuitive_resized_cab4ddef01.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)