Advertisement|Remove ads.

Will Super Micro Stock’s Rally Resume? Most Retail Traders Eye Upside if AI Server Maker Meets Nasdaq Deadline For Financial Reports

Super Micro Computer, Inc. (SMCI) has extended its rally since early February, crossing the $50 mark last week. The upside momentum follows the AI server maker’s fiscal Q2 2025 business update, but a key deadline now looms.

Super Micro has until Feb. 25 to catch up on its financial filings or risk delisting from Nasdaq.

The San Jose, California-based company has yet to file its 10-K for fiscal 2024 and its 10-Qs for the first two quarters of fiscal 2025. Despite this, retail investors are holding firm.

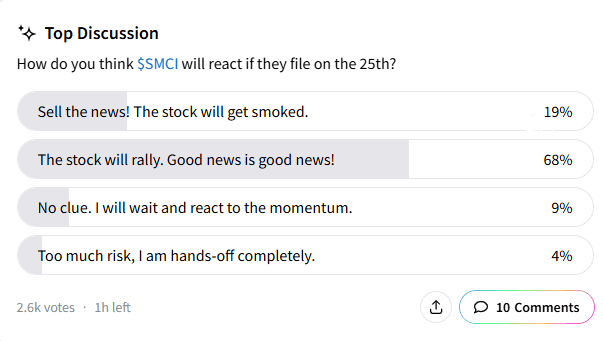

A Stocktwits poll of 2,600 users found that 68% expect the stock to rally once filings are made by the deadline.

Nineteen percent anticipate a “sell-the-news” pullback, 9% are waiting to see how the stock moves, and 4% view Super Micro as too risky.

Some respondents believe a move past $100 is possible, referencing the stock’s March 8 all-time high of $122.90 before it fell amid accounting concerns.

Others see potential gains from ETF inclusions.

Separately, Goldman Sachs raised its price target on Super Micro to $36 from $32 while maintaining a ‘Neutral’ rating, according to The Fly.

The research firm attributed the company’s second-quarter revenue and margin miss to the ongoing transition from Nvidia’s Hopper to Blackwell platforms.

On Feb. 5, Super Micro announced that its AI data center solution, “Building Black Solutions,” powered by Blackwell, is now fully production-ready.

Goldman expects the company to continue raising capital beyond the $700 million it recently secured to support working capital as it aims for $40 billion in fiscal 2026 revenue.

Analysts noted that Super Micro remains confident in its production capacity to meet that goal.

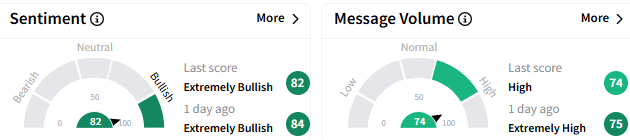

Stocktwits sentiment on Super Micro remains ‘extremely bullish’ (82/100), though message volume has moderated.

A bullish trader shared a chart highlighting a potential flag formation, suggesting the next breakout move could be imminent.

Another user said institutional investors are waiting to jump in, once the company files the financial reports by the Feb. 25 deadline.

Goldman’s updated price target is about 36% lower than the stock’s Friday closing price of $56.07. The stock shed 5.40% on Friday amid the broader market sell-off.

Super Micro’s stock is up about 84% since the start of the year.

The Tip Ranks-compiled consensus price target for Super Micro stock is $37.17, suggesting a potential 33.71% downside.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Rumble Moves To Sell 103.3M In Stock, Paving Exit For Tether: Retail Sentiment Stays Weak

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)