Advertisement|Remove ads.

Merck Retail Traders See Buying Opportunity As Stock Dives Toward Worst Day In 17 Years On Weak Guidance

Merck & Co. Inc. shares plunged more than 10% on Tuesday as a weak 2025 outlook overshadowed its upbeat fourth-quarter earnings. The stock was on track for its worst intraday drop since June 22, 2008.

The drugmaker reported fourth-quarter revenue of $15.62 billion, exceeding analysts' expectations of $15.48 billion.

Adjusted earnings per share came in at $1.72, topping the consensus estimate of $1.61.

Keytruda, Merck's blockbuster cancer immunotherapy, saw sales climb 19% to $7.84 billion, but the company struggled elsewhere.

Gardasil, its HPV vaccine, posted a 17% decline in sales to $1.55 billion, primarily due to lower demand in China. Revenue from the diabetes drug Januvia fell 38% to $487 million, pressured by declining U.S. pricing.

Merck's full-year 2025 forecast fell short of expectations. The company expects annual revenue between $64.1 billion and $65.6 billion, below the consensus estimate of $67.36 billion, citing a roughly 2% negative impact from foreign exchange.

It also projected adjusted earnings per share of $8.88 to $9.03, missing Wall Street's target of $9.21.

The company's decision to pause shipments of Gardasil to China starting in February 2025, with no resumption expected until mid-year at the earliest, was a key factor in the disappointing guidance.

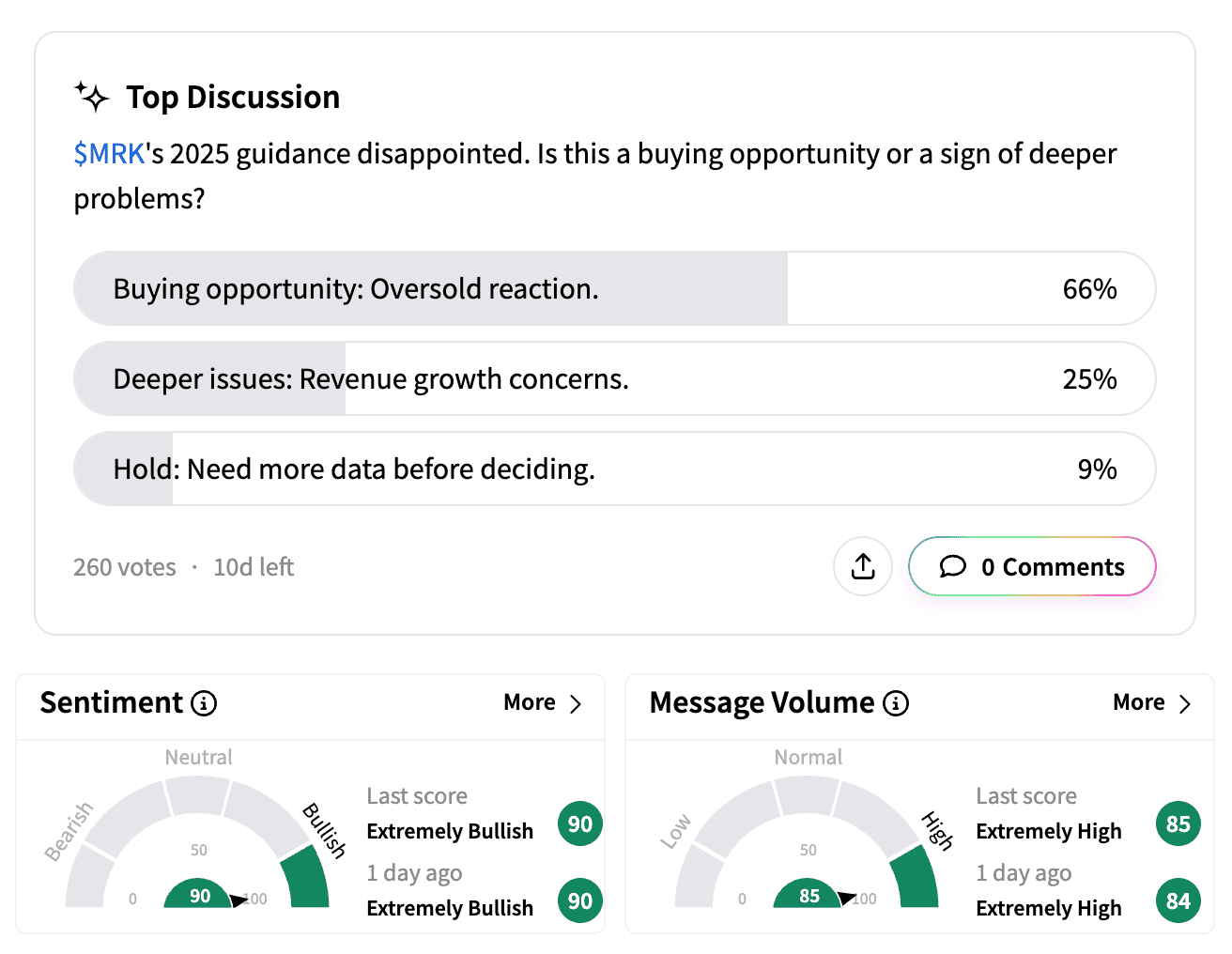

Retail traders on Stocktwits responded with a surge in message volume, sending sentiment to 'extremely bullish' levels despite the stock's steep decline.

A Stocktwits poll revealed that 67% of respondents saw Tuesday's plunge as an overreaction and a buying opportunity, while 25% believed the revenue outlook raised deeper concerns. The remaining 8% opted to hold their positions, preferring to wait for more data before making a move.

One user argued that Merck will maintain a diverse and robust pipeline by 2030. Another, frustrated by the stock's performance, indicated they would continue holding for the dividend despite their disappointment.

Gardasil's performance in China is expected to be crucial in Merck's ability to offset future revenue losses, especially as Keytruda nears its 2028 patent expiration.

Sales of the HPV vaccine had been strong in China until last year when, according to the company, economic headwinds disrupted demand.

The company has said it remains focused on improving patient education and promotion of the vaccine to regain momentum in the market.

Merck's stock has dropped nearly 30% over the past 12 months, during which message volume on Stocktwits has surged more than sixfold.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)