Advertisement|Remove ads.

Moderna Stock Sinks To Over 5-Year Low On $1B Sales Guidance Cut: Retail’s Shaken

Shares of Moderna, Inc. plunged over 20% on Monday to their lowest levels since mid-April 2020 and were on course to mark their worst day on record.

This sharp decline follows the company’s decision to lower its 2025 sales guidance by approximately $1 billion, citing a challenging outlook in the COVID-19 vaccine market.

Moderna now forecasts 2025 revenues of $1.5 billion to $2.5 billion, down from its previous estimate of $2.5 billion to $3.5 billion.

The revised projection largely reflects declining COVID-19 vaccine demand, as fewer people seek boosters amid the ongoing shift to an endemic phase.

Last year, Moderna’s COVID-19 vaccine sales alone plummeted to $6.7 billion, down from $18 billion in 2022, with a further drop expected in 2025.

CEO Stéphane Bancel noted that the company achieved its $3.0-$3.1 billion 2024 sales target, bolstered by the approval of its respiratory syncytial virus (RSV) vaccine and ongoing adaptations in the COVID business.

"We remain focused on our three strategic priorities: driving sales growth, delivering up to 10 product approvals over the next three years, and reducing costs across our business," Bancel said in prepared remarks.

The company said it has reduced its operating costs by over 25% in 2024, with plans to save an additional $1 billion in 2025.

CFO Jamey Mock told CNBC that factors weighing on sales include intensified competition in the COVID market, falling vaccination rates, uncertainty around RSV vaccine uptake, as well as risks tied to manufacturing contracts and CDC recommendations for future RSV vaccinations.

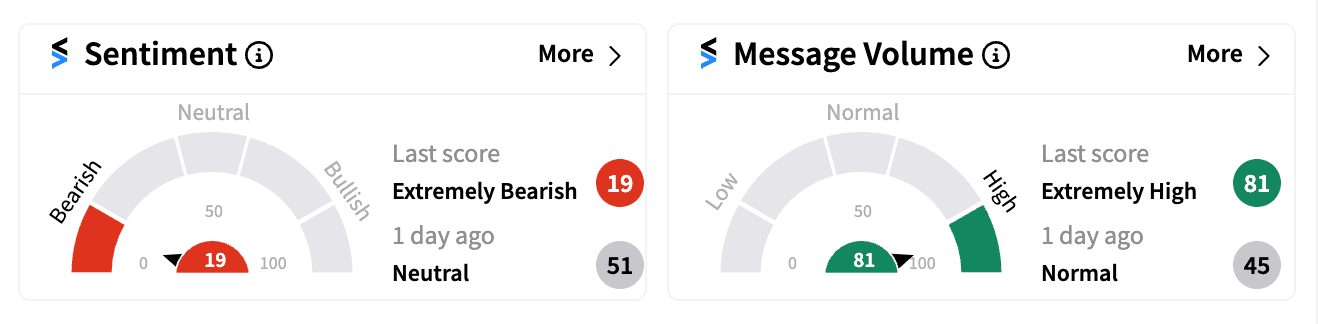

On Stocktwits, sentiment for Moderna plunged to ‘extremely bearish’ levels, hitting levels last seen in February 2024. Meanwhile, soaring message volume drove the ticker into the top three trending symbols on the platform.

Skeptics predicted the stock hitting new lows, with some criticizing the management and others claiming the company did not do enough to diversify its pipeline or acquire other companies as the COVID-19 pandemic waned.

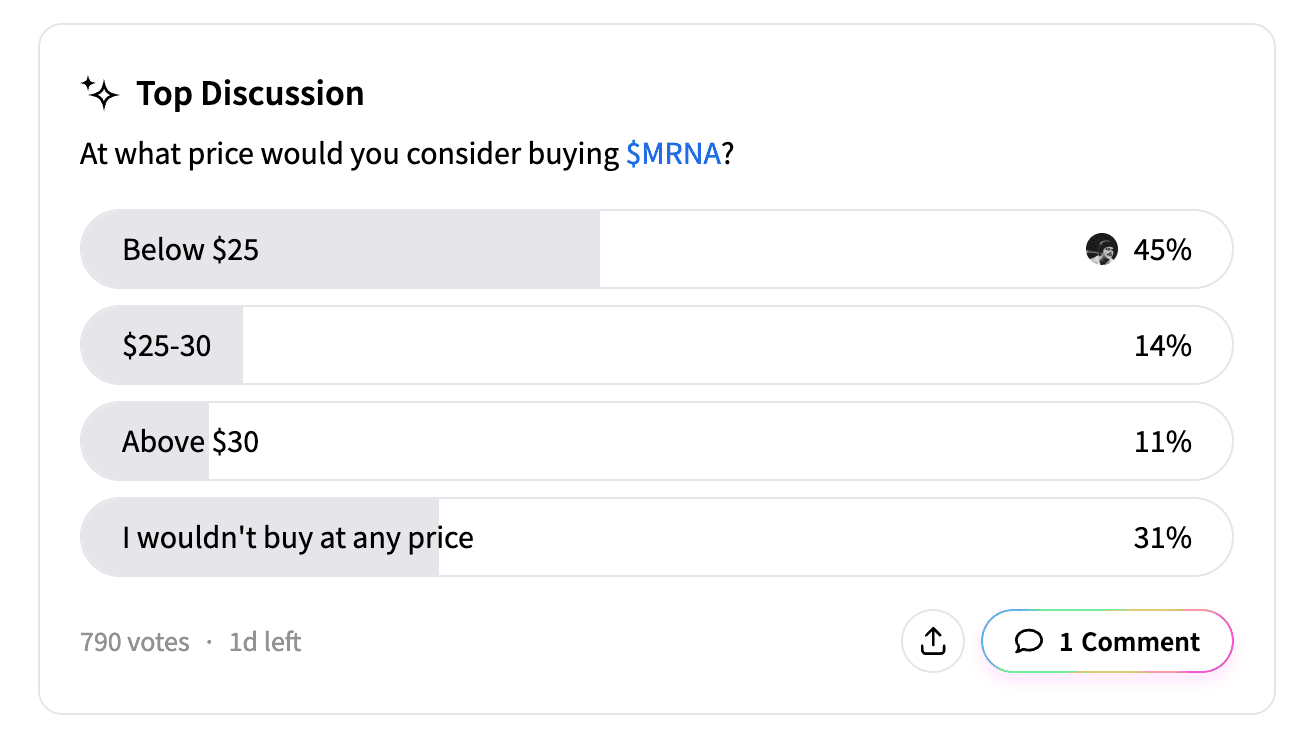

In a Stocktwits poll asking at what price investors would ideally buy Moderna stock, 41% responded with “below $25,” while 31% stated they would not buy at any price.

Once a high-flyer in the biotech space, Moderna’s stock has lost 63% in 2024, making it one of the S&P 500’s worst performers.

However, there has been renewed investor interest in its H5N1 bird flu vaccine candidate following the recent bird flu death in the U.S.

The stock has lost over 20% since the start of the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)