Advertisement|Remove ads.

Moderna’s Q4 Losses Worse Than Feared, But Revenue Beat And Cost Cuts Boost Stock — Retail Sentiment Follows

Moderna, Inc. (MRNA) shares were up over 3% in choppy trading on Friday afternoon, even as the biotech firm reported a wider-than-expected quarterly loss and issued a 2025 revenue forecast with a midpoint below analyst estimates.

The company posted a fourth-quarter net loss of $2.91 per share, missing the consensus estimate of a $2.76 loss. Moderna said the results included a $238 million non-cash charge tied to the termination of a contract manufacturing agreement.

Revenue for the quarter came in at $966 million, surpassing expectations of $941.1 million.

Sales of Spikevax, its COVID-19 vaccine, fell 66% year over year to $923 million but still topped forecasts of $909 million.

The company also reported $15 million in sales from its RSV vaccine, mRESVIA, slightly ahead of an estimated $13 million.

Chief Financial Officer Jamey Mock told CNBC that a key takeaway from 2024 was the 27% reduction in costs compared to the prior year.

Moderna CEO Stéphane Bancel added that the company remains focused on driving sales and achieving up to 10 product approvals by 2027.

“By the end of 2025, we aim to remove nearly $1 billion in costs,” Bancel said in prepared remarks. “With strong momentum in our late-stage pipeline, we anticipate multiple approvals starting this year, along with key Phase 3 readouts that will support our long-term growth.”

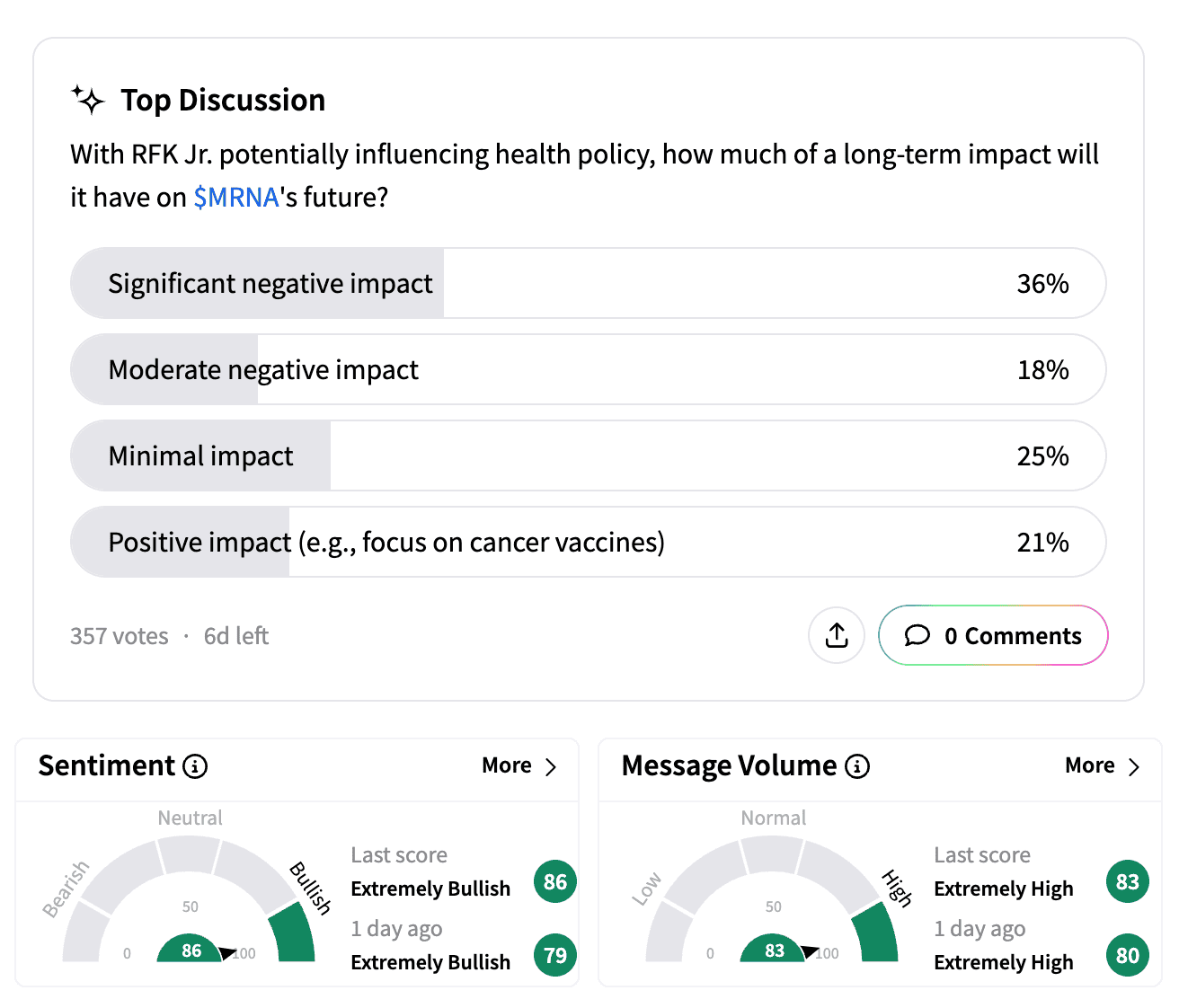

On Stocktwits, sentiment turned even more ‘extremely bullish’ by midday amid a jump in message volume, with some traders lauding Moderna’s cost cuts, pipeline progress, and balance sheet strength.

Still, the company’s 2025 revenue outlook of $1.5 billion to $2.5 billion has a midpoint of $2 billion, below Wall Street’s $2.22 billion estimate.

Moderna expects only around $200 million in revenue during the first half of the year, citing respiratory vaccine seasonality.

Beyond respiratory vaccines, retail chatter has centered on Moderna’s H5N1 bird flu vaccine candidate.

Rising bird flu cases in the U.S. and a recent $590 million award from the Department of Health and Human Services to accelerate the vaccine’s development have reignited interest in the program.

However, regulatory concerns are emerging. A Stocktwits poll showed many investors believe the recent confirmation of vaccine skeptic Robert F. Kennedy Jr. as the new HHS chief under the Trump administration could significantly hurt Moderna’s stock.

Moderna shares are down more than 23% year-to-date, with short interest recently reported at 11.2%, according to Koyfin data.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)