Advertisement|Remove ads.

Muddy Waters Disclosed Short Position On FTAI Aviation In January — It Now Says The Company Could Be Violating US Sanctions Against Iran

FTAI Aviation (FTAI) shares declined by over 5% on Monday noon after Muddy Waters Research said the company could be violating U.S. sanctions on Iran.

Muddy Waters said an Iranian engine shop appears to have acquired an FTAI Engine Module. The report cited evidence published on LinkedIn in January and February 2025 by an Iranian airline executive of Sorena Turbine, an aircraft MRO based in Iran.

“The online posts clearly show two CFM-56 engines and FTAI packaging adjacent to the engines at the shop. It, therefore, seems that Sorena has obtained product from FTAI’s Aerospace Products business. This seemingly violates U.S. OFAC sanctions for which we understand the U.S. seller would be strictly liable,” the report said.

The company said that although the evidence was initially obtained from still photos and videos posted on LinkedIn, it confirmed that the parts in question “are indeed in Iran by comparing landmarks in videos to imagery from Google Earth.” Sorena Turbine is a maintenance, repair, and overhaul (MRO) company located in Tehran.

Muddy Waters Research noted that it’s unclear whether this was a one-off or part of a pattern of widespread prohibited conduct.

“To the extent it’s more towards the latter, this would raise serious questions overall about FTAI’s culture and business. Considering that FTAI personnel are potentially exposed to prison sentences, the company should thoroughly investigate to what extent its business is connected to Iranian purchasers,” it added.

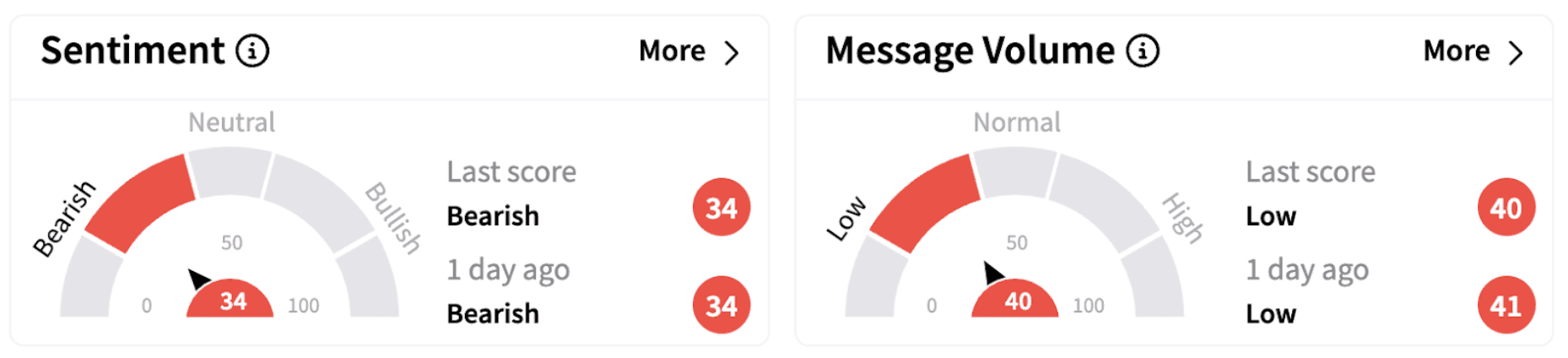

Meanwhile, on Stocktwits, retail sentiment continued to trend in the ‘bearish’ territory (34/100).

In January of this year, Muddy Waters stated it was short on FTAI because its financial reporting was highly misleading.

“We believe revenue from true maintenance and individual off-the-rack module sales are materially lower than reported. FTAI, in our view, is misleading investors by reporting one-time engine sales as Maintenance Repair & Overhaul (MRO) revenue in its Aerospace Products (AP) segment,” the company stated in its report.

It added that the goal of these misrepresentations appears to be to generate a valuation materially greater than that of a leasing business.

Later that month, Snowcap Research, too, disclosed a short position on the stock.

FTAI stock has lost nearly 15% in 2025 but has more than doubled over the past year.

Also See: Occidental Petroleum Announces Temporary Reduction In Warrants Exercise Price: Retail’s Unimpressed

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2246431195_jpg_539619e6b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)