Advertisement|Remove ads.

Mullen Automotive Stock Slides 15% As 1-for-100 Reverse Split Kicks In: Retail Frustrated

Shares of electric vehicle manufacturer Mullen Automotive (MULN) slid up to 15% on Tuesday after a 1-for-100 reverse stock split announced last week came into effect.

The firm had effected the reverse stock split to bring the company into compliance with the $1.00 minimum bid price requirement for maintaining its listing on Nasdaq.

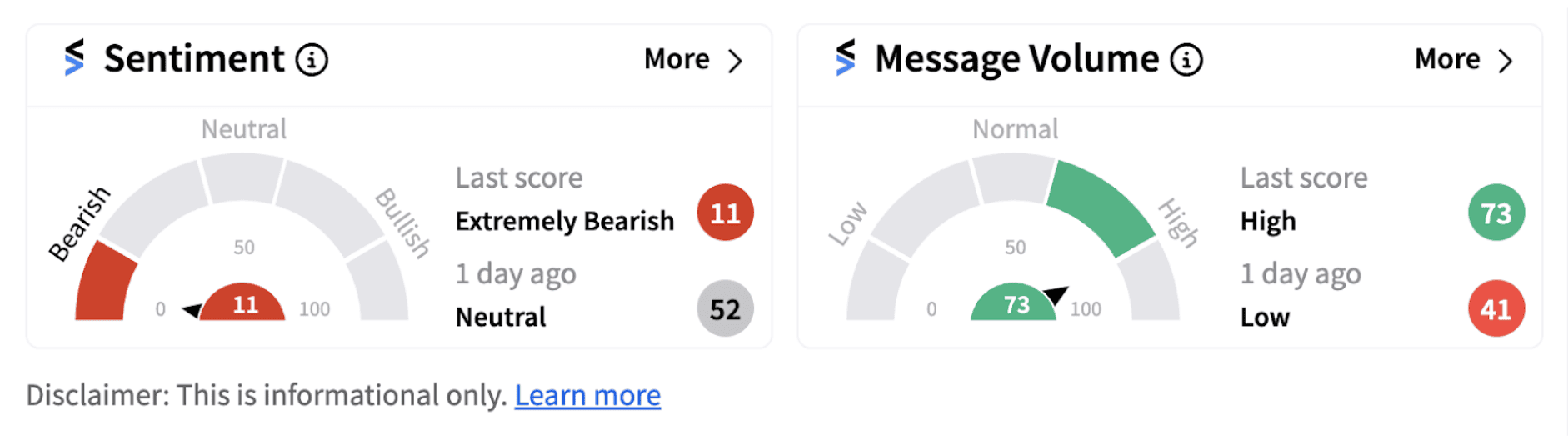

Retail sentiment on Stocktwits fell into the ‘extremely bearish’ territory (11/100), hitting a one-year low. The move was accompanied by ‘high’ message volume (73/100).

A majority of the retail followers of the firm on Stocktwits are unhappy with the reverse split decision.

One user named ‘TerraOmega’ believes the stock may see further downside in the near term.

In May, the firm had announced a limited duration stockholder rights plan, which it said was intended to protect Mullen and its stockholders from efforts by a single stockholder or group to obtain control of the firm without paying a control premium. The firm had said the rights plan was effective immediately and will expire on May 1, 2025.

The EV-maker also announced a $100 million financing commitment from a family office and said it has sold up to an additional $50 million of senior secured convertible notes to family offices and high net worth investors. According to the firm, these commitments satisfied its capital needs over the next 13 months.

On Tuesday, the company announced the addition of full-service dealer, Papé Kenworth, to its commercial EV dealer network. Papé Kenworth is the firm’s seventh franchise dealer partner expanding fleet opportunities for the company’s commercial electric vehicles.

Despite all the measures, Mullen shares are down over 22% on a year-to-date basis and have lost over 99% of their market cap over the last five years.

With the latest reverse-split announcement, the firm may find it more difficult to calm investor nerves.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Altcoins_ff3521c963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244475103_jpg_13c45a71c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_ed6fc0a54f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jim_Cramer_82051b390e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_I_Shares_25784fa2dc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_891861286_jpg_f5527520c5.webp)