Advertisement|Remove ads.

Multi-Timeframe Breakout: SEBI RAs Bullish On JSW Steel Post Q1 Update

JSW Steel reported a consolidated crude steel production of 7.26 million tonnes in the first quarter of FY26, marking a 14% year-on-year increase. However, its production dropped 5% due to planned maintenance at select blast furnaces.

They added that all its furnaces have resumed operations and are now running optimally. The company's Indian facilities achieved 87% capacity utilization for the quarter, noting that the temporary production decrease was a planned part of its maintenance strategy.

SEBI-registered analyst Vinayak Gautam recommended buying JSW Steel at ₹1,050, with a target price of ₹1,110, a stop-loss of ₹1,020, and a time horizon of three to four months.

Meanwhile, analyst Dhruv Tuli has flagged a confirmed breakout on the daily chart, with a strong close above the extended 1.618 Fibonacci level, where the price was previously rejected. He added that the stock was now holding above that zone with confidence.

On the monthly chart, the stock found clean support at the 1.0 Fib level, indicating strength.

While its daily Relative Strength Index (RSI) showed a bullish divergence, its monthly RSI still has room to move higher, according to Tuli.

He concluded that this was a multi-timeframe confluence setup with solid technical structure, and that he expects the stock to test new highs in the coming weeks.

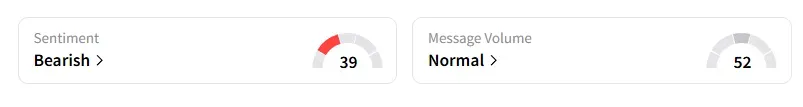

However, data on Stocktwits shows that retail sentiment has been ‘bearish’ on the counter for a week.

JSW Steel shares have risen 16% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)