Advertisement. Remove ads.

Muthoot Finance hints at higher growth guidance as momentum holds

Managing Director George Alexander Muthoot said that while the recent goods and services tax (GST) rate reductions do not directly affect Muthoot Finance, they are expected to leave customers with higher disposable income and indirectly benefit the company.

Share this article

Kerala-based gold loan financier Muthoot Finance is preparing to raise its FY26 growth guidance from the earlier estimate of 15%, with Managing Director George Alexander Muthoot indicating that strong business momentum could push the figure above 20% when it is formally revised in the second quarter.

“As it stands in the first quarter, we have done well. Second quarter also we are doing well," he said.

Last year, Muthoot Finance posted nearly 40% AUM growth, and the performance in the first quarter of the current year has remained encouraging.

“We are focused on doing the business better and growing the AUM,” Muthoot said, while noting that the company will formally announce the revised figure in the second quarter.

The upbeat commentary reinforces the company’s strong position in the gold loan market and its ability to maintain momentum in both urban and rural segments.

While the recent goods and services tax (GST) rate reductions do not directly affect Muthoot Finance, they are expected to leave customers with higher disposable income.

This could indirectly benefit the company, as borrowers may find it easier to repay loans and, at the same time, show greater willingness to take fresh loans.

On concerns around RBI’s reported view of overlapping businesses within subsidiaries, Muthoot Finance confirmed that it has not received any such directive. The company remains committed to complying with any regulatory requirement, signalling minimal disruption risk.

The company also recently raised $600 million through an external commercial borrowing (ECB) to diversify its funding sources.

He reiterated the company's practice of passing on the benefits of lower funding costs to customers while maintaining its net interest margin, which he guided would be in the range of 5.5% to 6%.

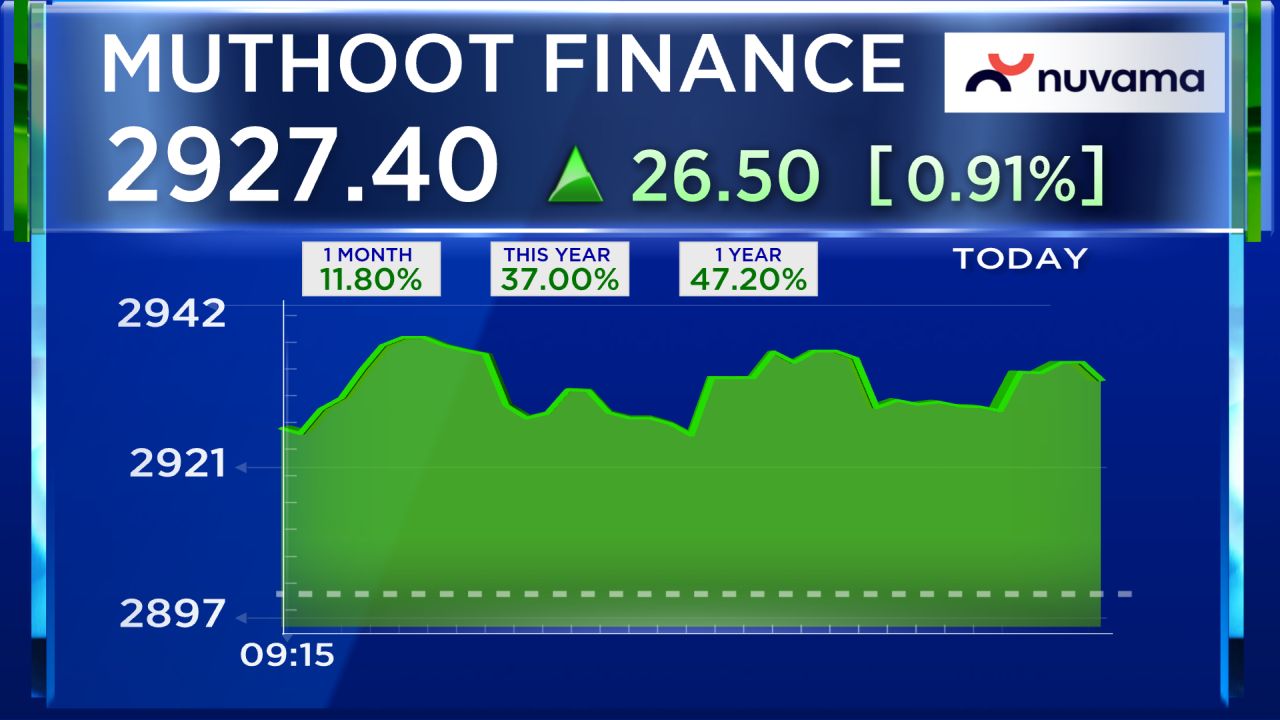

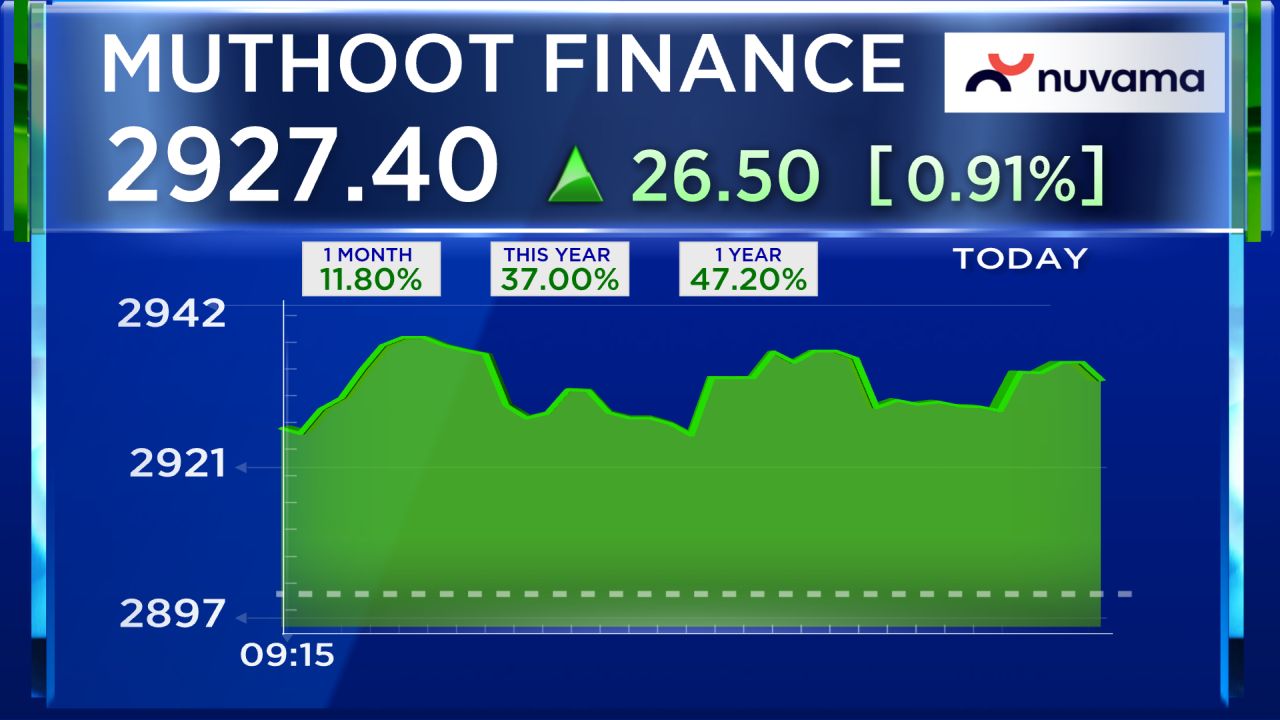

Muthoot Finance’s current market capitalisation is ₹1,17,566 crore. The stock is currently trading at ₹2,928.80 as of 10:16 am on the NSE and has gained 47% over the last year.

Follow our live blog for more stock market updates

Read about our editorial guidelines and ethics policy“As it stands in the first quarter, we have done well. Second quarter also we are doing well," he said.

Last year, Muthoot Finance posted nearly 40% AUM growth, and the performance in the first quarter of the current year has remained encouraging.

“We are focused on doing the business better and growing the AUM,” Muthoot said, while noting that the company will formally announce the revised figure in the second quarter.

The upbeat commentary reinforces the company’s strong position in the gold loan market and its ability to maintain momentum in both urban and rural segments.

While the recent goods and services tax (GST) rate reductions do not directly affect Muthoot Finance, they are expected to leave customers with higher disposable income.

This could indirectly benefit the company, as borrowers may find it easier to repay loans and, at the same time, show greater willingness to take fresh loans.

On concerns around RBI’s reported view of overlapping businesses within subsidiaries, Muthoot Finance confirmed that it has not received any such directive. The company remains committed to complying with any regulatory requirement, signalling minimal disruption risk.

The company also recently raised $600 million through an external commercial borrowing (ECB) to diversify its funding sources.

He reiterated the company's practice of passing on the benefits of lower funding costs to customers while maintaining its net interest margin, which he guided would be in the range of 5.5% to 6%.

Muthoot Finance’s current market capitalisation is ₹1,17,566 crore. The stock is currently trading at ₹2,928.80 as of 10:16 am on the NSE and has gained 47% over the last year.

Follow our live blog for more stock market updates

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/06/8-2024-06-5d5c293b714bc26c8c075635b91d1e9a.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_figure_logo_OG_jpg_c0809abe4d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_walmart_logo_jpg_86f75103fe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ford_logo_resized_eb4298c9b3.jpg)