Advertisement|Remove ads.

NBFCs look to stronger second half after patchy Q2 performance

Shweta Daptardar, Vice President – Diversified Financials at Elara Securities, said segments such as gold finance, MSME lending, and personal loans are likely to drive growth and improve valuations.

India’s non-banking financial companies (NBFCs) are expected to deliver a mixed performance in the July–September quarter of FY26 (Q2FY26). The second half of FY26 could see better traction aided by GST cuts, improving demand, and volume recovery.

Second quarter business updates of retail-focused players such as Bajaj Finance and L&T Finance showed strong year-on-year growth in assets under management (AUM). In contrast, Mahindra & Mahindra Finance showed some weakness, with AUM rising by around 13% during the same period.

Overall growth in the quarter is likely to remain subdued for most players, though disbursement activity may see a gradual recovery. Asset quality pressures could persist, but some support may come from margin expansion.

The MSME and microfinance (MFI) segments may continue to face pressure. Yet, this quarter will likely benefit from the full impact of the 100 basis point repo rate cut, which is expected to lift margins across the board.

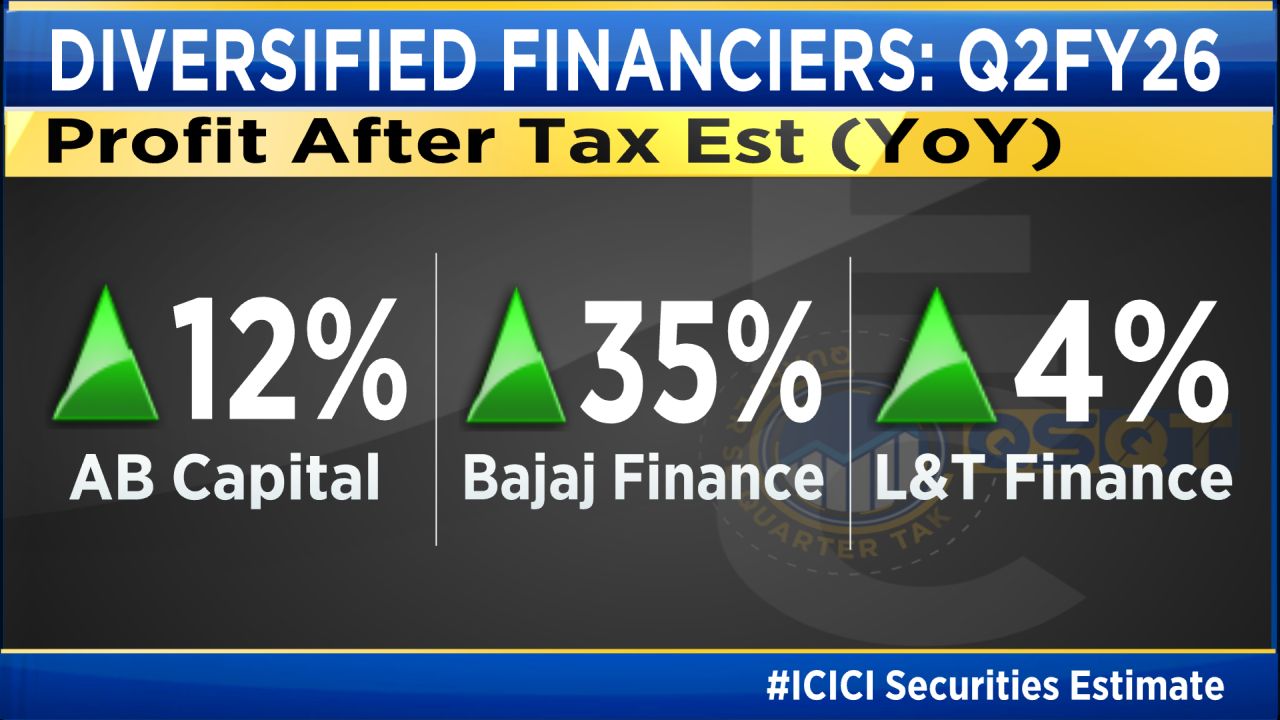

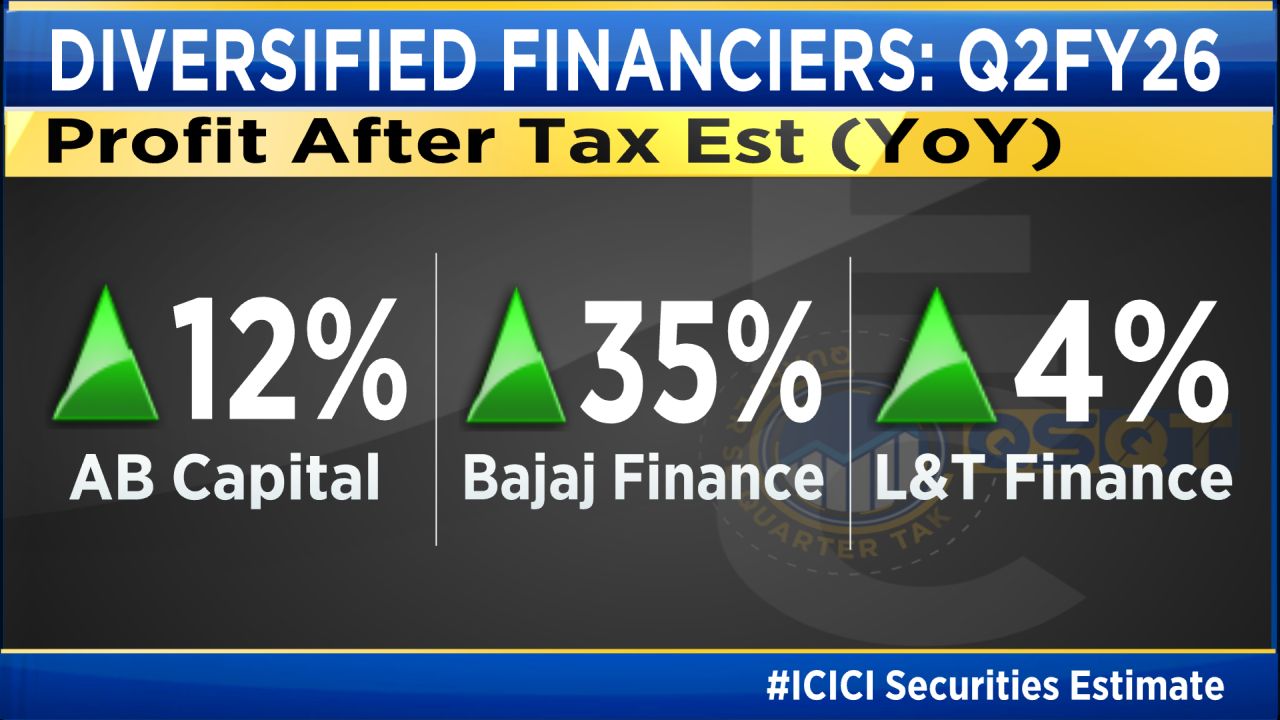

For diversified financiers, disbursements are expected to improve, credit costs should remain steady, and margins may show some improvement. These factors could drive profit growth in the range of 12–30% year-on-year, while return on assets (ROAs) are expected to stay stable for the quarter.

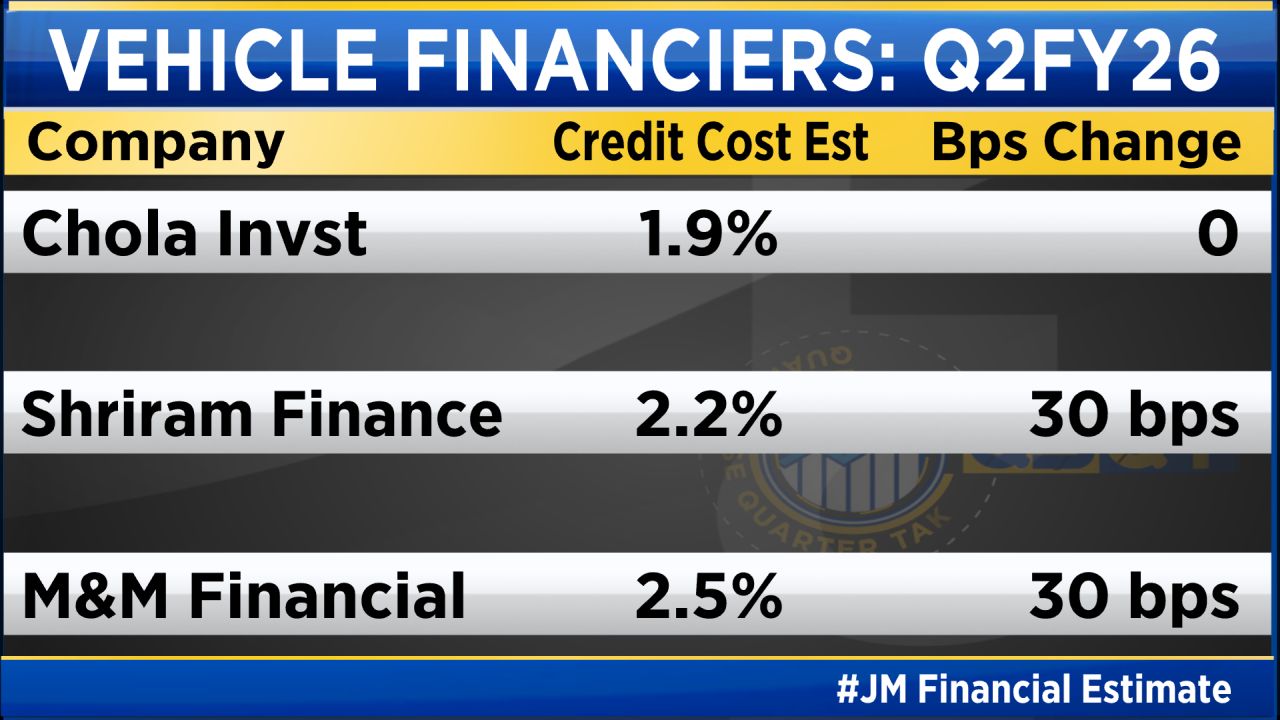

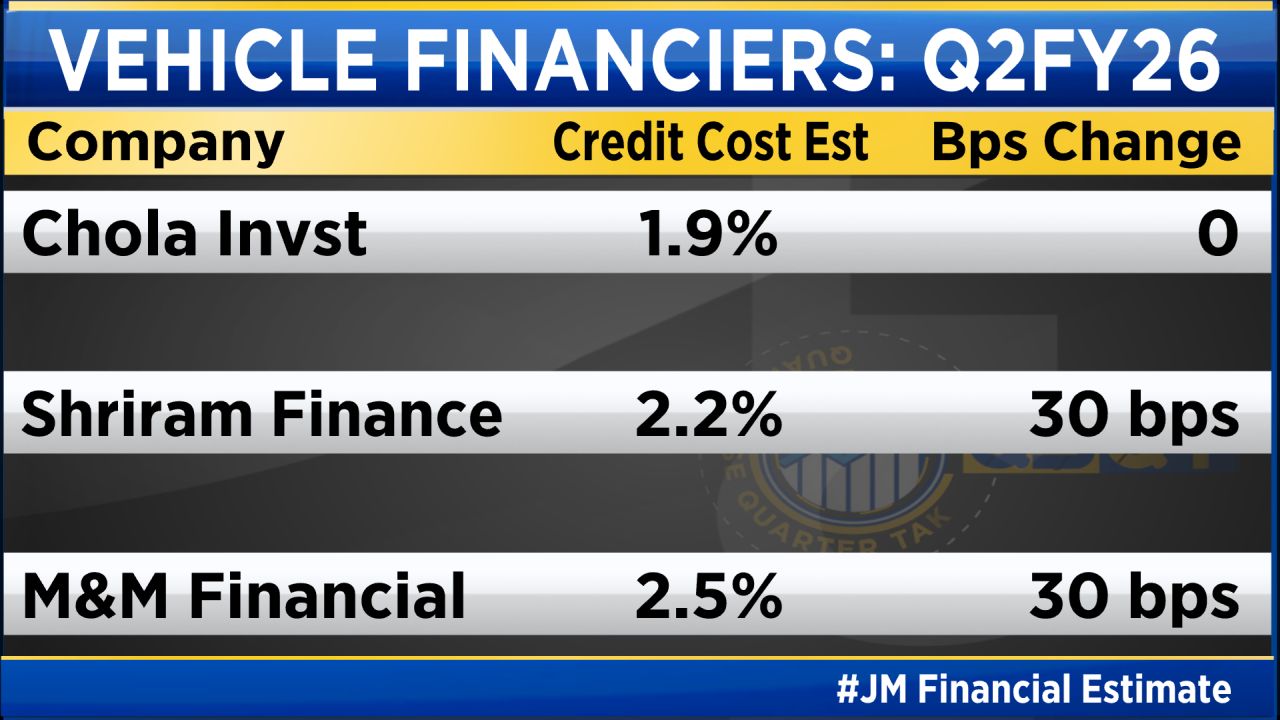

AUM growth in the vehicle financing space is likely to moderate. Cholamandalam Finance has already revised its growth guidance lower, and analysts expect overall sector growth to stay around 20%.

Despite this, profitability should remain strong due to margin expansion from fixed-rate vehicle loans. Credit costs, however, could rise, as some lenders — including Kotak Mahindra Bank and HDB Financial Services — have flagged stress in the commercial vehicle (CV) segment.

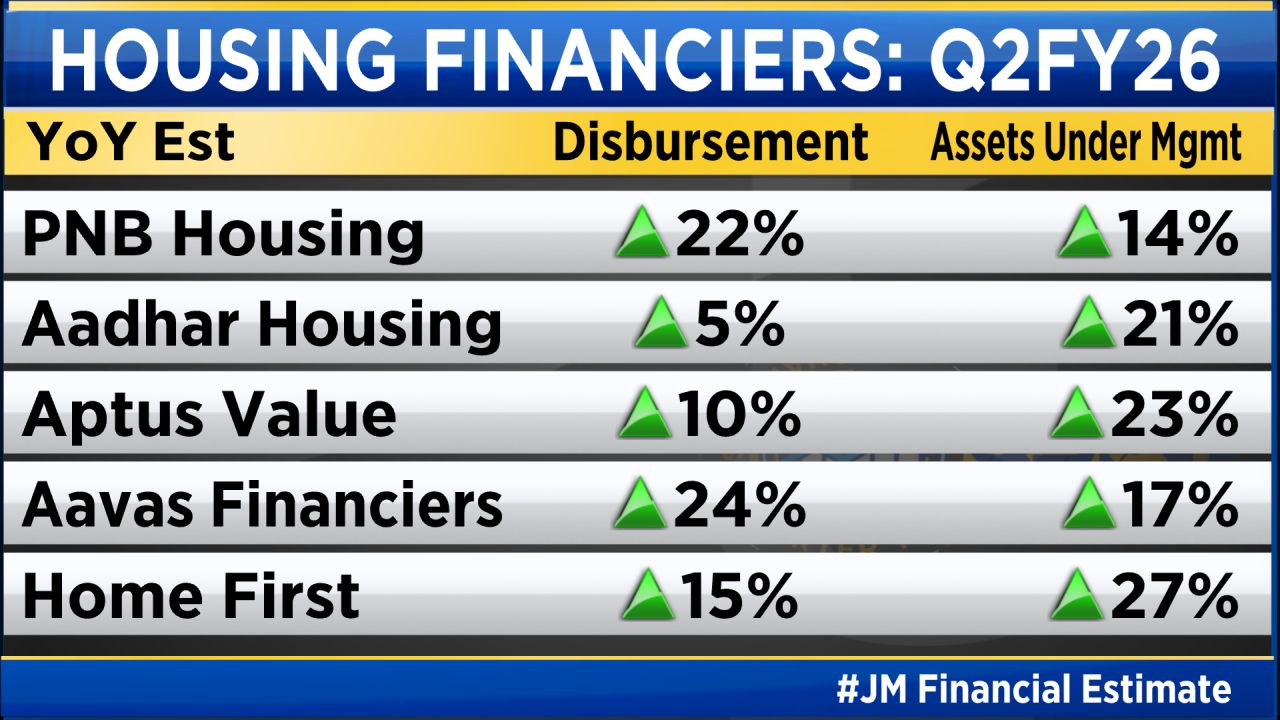

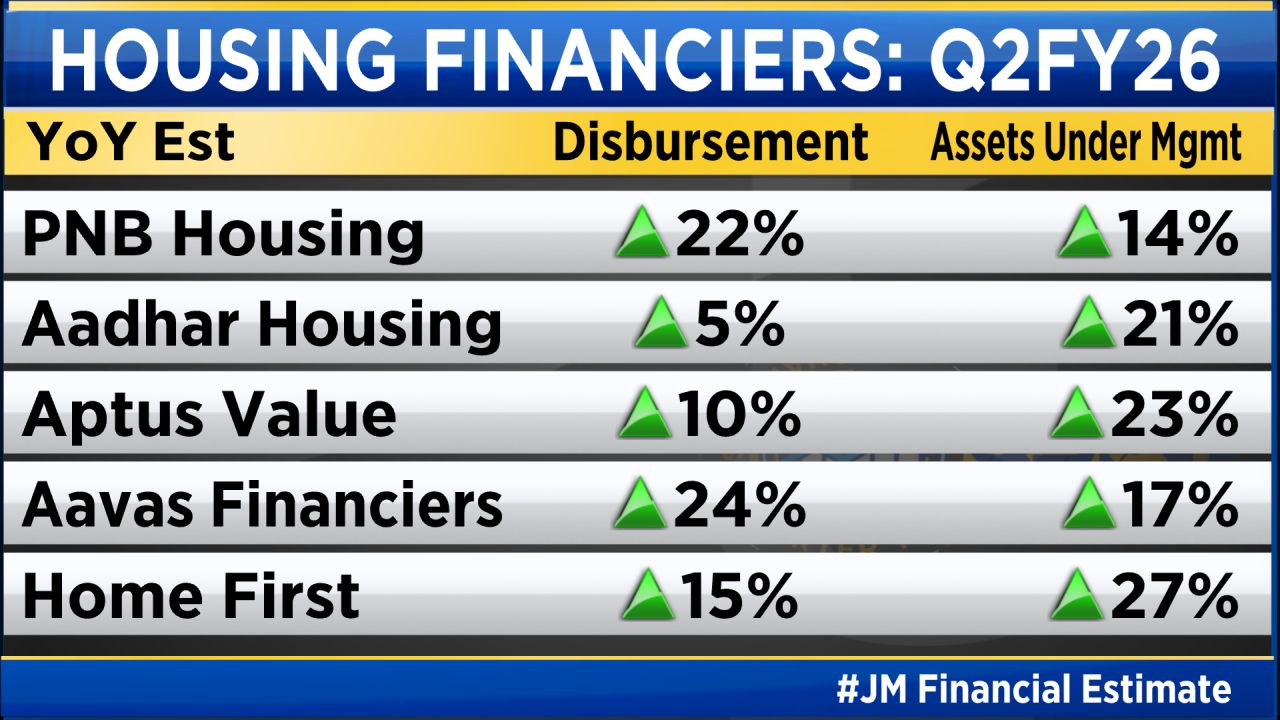

In the housing finance segment, disbursements are expected to remain healthy for players such as Aavas Financiers and Aptus Value Housing Finance. However, Aadhar Housing Finance may see some weakness in disbursement growth.

Credit costs are likely to decline, while net interest margins (NIMs) could improve — leading to an expansion in ROAs by up to 20 basis points.

The microfinance (MFI) segment is expected to remain under pressure due to asset quality issues and higher credit costs. Return ratios are unlikely to improve in quarter two, but the segment may be nearing its bottom.

Gradual recovery is expected in the coming quarters as MFIs diversify beyond their traditional focus and benefit from the RBI’s relaxed regulatory guardrails.

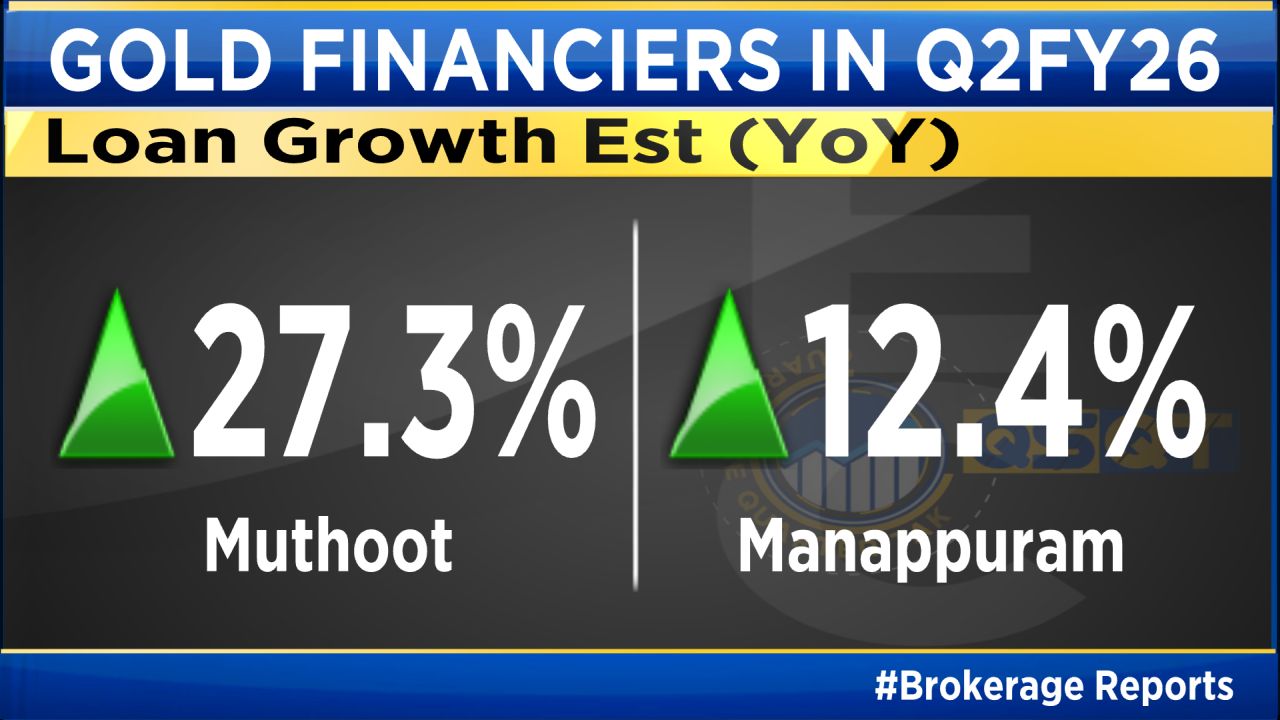

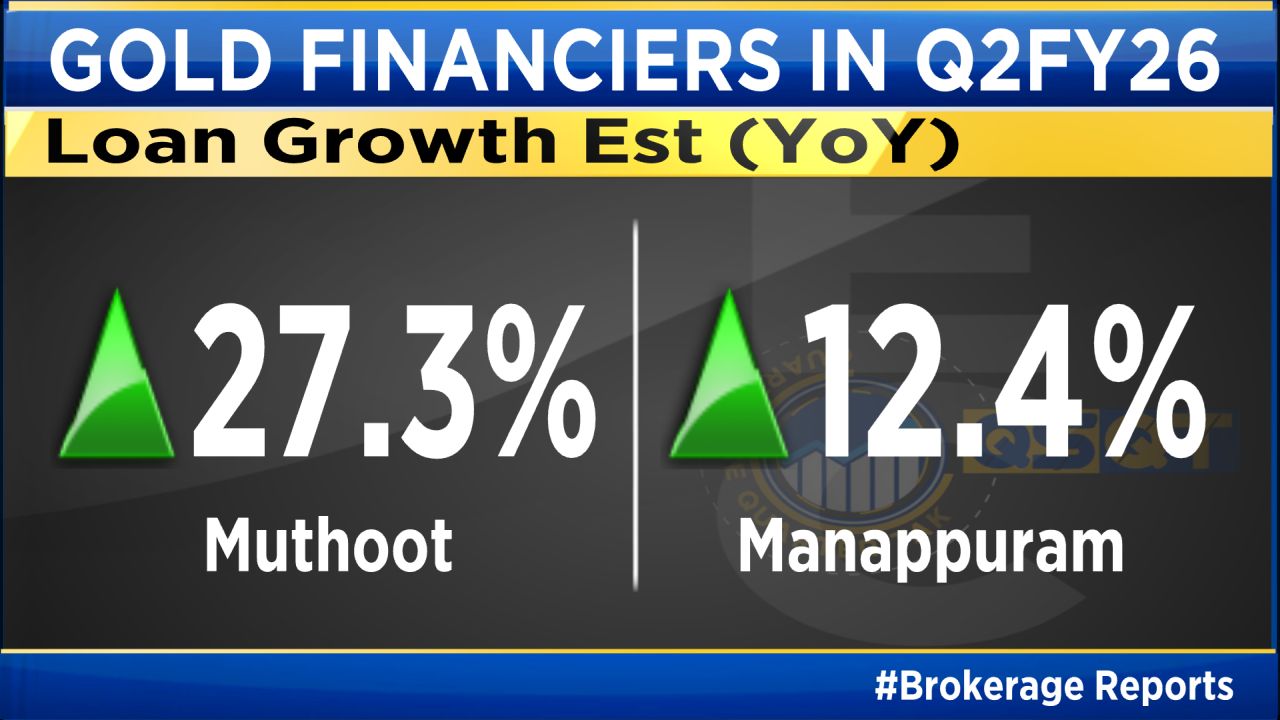

Gold financiers such as Muthoot Finance and Manappuram Finance are expected to post strong performance on the back of rising gold prices.

For Manappuram, total loan growth may remain moderate, but the gold loan book could expand by about 20% in FY26. Both lenders are likely to see healthy margin expansion, with Muthoot expected to sustain an ROA of around 2.5%.

Manappuram’s profitability may also improve as provisioning requirements in its MFI arm decline.

According to Shweta Daptardar, Vice President – Diversified Financials at Elara Securities, segments such as gold finance, MSME lending, and personal loans are likely to drive growth and improve valuations.

“Gold financiers and MSME lenders continue to dominate overall credit growth and demand,” said Daptardar. “The second half looks very strong for MSME credit, and the pain cycle in personal loans is now fully behind us.”

Among key beneficiaries, she mentioned Bajaj Finance, L&T Finance, and several mid- and small-sized MSME lenders, which could see meaningful growth in the second half of the fiscal year.

On the gold financing front, Daptardar remains positive on Muthoot Finance, even as the stock trades at a premium.

For the entire discussion, watch the accompanying video

Second quarter business updates of retail-focused players such as Bajaj Finance and L&T Finance showed strong year-on-year growth in assets under management (AUM). In contrast, Mahindra & Mahindra Finance showed some weakness, with AUM rising by around 13% during the same period.

Overall growth in the quarter is likely to remain subdued for most players, though disbursement activity may see a gradual recovery. Asset quality pressures could persist, but some support may come from margin expansion.

The MSME and microfinance (MFI) segments may continue to face pressure. Yet, this quarter will likely benefit from the full impact of the 100 basis point repo rate cut, which is expected to lift margins across the board.

For diversified financiers, disbursements are expected to improve, credit costs should remain steady, and margins may show some improvement. These factors could drive profit growth in the range of 12–30% year-on-year, while return on assets (ROAs) are expected to stay stable for the quarter.

AUM growth in the vehicle financing space is likely to moderate. Cholamandalam Finance has already revised its growth guidance lower, and analysts expect overall sector growth to stay around 20%.

Despite this, profitability should remain strong due to margin expansion from fixed-rate vehicle loans. Credit costs, however, could rise, as some lenders — including Kotak Mahindra Bank and HDB Financial Services — have flagged stress in the commercial vehicle (CV) segment.

In the housing finance segment, disbursements are expected to remain healthy for players such as Aavas Financiers and Aptus Value Housing Finance. However, Aadhar Housing Finance may see some weakness in disbursement growth.

Credit costs are likely to decline, while net interest margins (NIMs) could improve — leading to an expansion in ROAs by up to 20 basis points.

The microfinance (MFI) segment is expected to remain under pressure due to asset quality issues and higher credit costs. Return ratios are unlikely to improve in quarter two, but the segment may be nearing its bottom.

Gradual recovery is expected in the coming quarters as MFIs diversify beyond their traditional focus and benefit from the RBI’s relaxed regulatory guardrails.

Gold financiers such as Muthoot Finance and Manappuram Finance are expected to post strong performance on the back of rising gold prices.

For Manappuram, total loan growth may remain moderate, but the gold loan book could expand by about 20% in FY26. Both lenders are likely to see healthy margin expansion, with Muthoot expected to sustain an ROA of around 2.5%.

Manappuram’s profitability may also improve as provisioning requirements in its MFI arm decline.

According to Shweta Daptardar, Vice President – Diversified Financials at Elara Securities, segments such as gold finance, MSME lending, and personal loans are likely to drive growth and improve valuations.

“Gold financiers and MSME lenders continue to dominate overall credit growth and demand,” said Daptardar. “The second half looks very strong for MSME credit, and the pain cycle in personal loans is now fully behind us.”

Among key beneficiaries, she mentioned Bajaj Finance, L&T Finance, and several mid- and small-sized MSME lenders, which could see meaningful growth in the second half of the fiscal year.

On the gold financing front, Daptardar remains positive on Muthoot Finance, even as the stock trades at a premium.

For the entire discussion, watch the accompanying video

Read about our editorial guidelines and ethics policy

/filters:format(webp)https://news.stocktwits-cdn.com/large_huntington_OG_jpg_0f4cdc1ca5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_chart_rising_resized_6ebc3dd7e4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2214520036_jpg_38627c2e7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_uptrending_stock_resized_e22f46d710.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/shanthi_v2_compressed_98c13b83cf.png)