Advertisement|Remove ads.

Netflix Price Target Lowered By UBS, Even as Company Reportedly Eyes $1T Market Cap

UBS has lowered its price target on Netflix (NFLX) to $1,140 from $1,150 while maintaining a ‘Buy’ rating, citing strong engagement trends and continued momentum despite a complex macroeconomic environment.

Even though the price target was slashed marginally, the reduction comes after a report by The Wall Street Journal on Monday said the company is looking to double revenue and hit a $1 trillion market capitalization by 2030.

The brokerage’s updated outlook acknowledges near-term headwinds, such as a weaker advertising market and strike-related content delays, per TheFly. Still, it maintains that Netflix is positioned to outperform in the broader media sector.

UBS expects Netflix’s upcoming first-quarter (Q1) results to reflect steady progress, forecasting 12% revenue growth and a 14% increase in operating income.

While these figures trail the prior year’s 16% revenue and 50% operating income growth, they still reflect a strong trajectory, UBS analyst John Hodulik’s wrote in a note to investors reported by Investing.com.

According to him, this quarter will focus on user engagement, with Netflix no longer disclosing detailed subscriber growth metrics.

UBS noted that its proprietary viewership tracker shows a rebound in consumption following a slowdown linked to Netflix’s paid-sharing crackdown and delayed content releases.

Engagement with top titles is once again trending upward, and the return of flagship franchises such as Stranger Things, Wednesday, and Squid Game is expected to support momentum through 2025.

UBS forecasts revenue will rise 12.5% for the full fiscal year, with operating income up 22%.

The estimate includes a slight 5% to 10% downward revision in ad revenue expectations, though UBS notes the impact is limited, as advertising currently comprises just 4% of Netflix’s total revenues.

Last week, KeyBanc lowered its price target to $1,000 from $1,100, citing weakness in ad revenue, but kept an ‘Overweight’ rating on the shares, as per TheFly.

UBS anticipates a 220-basis-point margin expansion, bringing full-year margins to 28.9%. This aligns with Netflix’s revenue growth guidance of between 12% and 14% and approximately 29% margins.

On Tuesday morning, Netflix shares surged over 5%, driven by renewed investor optimism about long-term growth and speculation of a potential stock split.

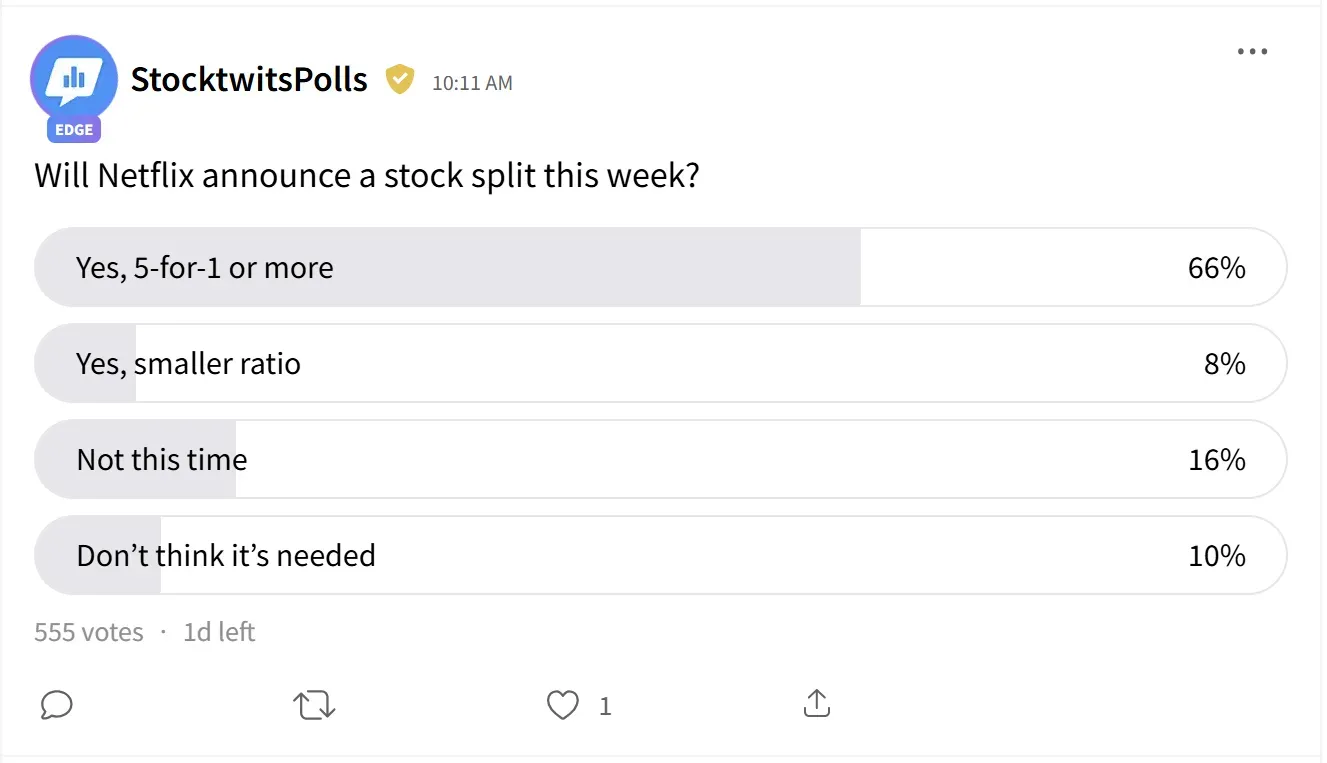

With Netflix’s stock price nearing $1,000, a 5-for-1 or larger split has become a widespread expectation among retail investors, according to an ongoing poll on Stocktwits.

Netflix’s stock has gained 10% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Bank Of America Ordered To Pay $540M In FDIC Lawsuit, But Avoids $2B Fine

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2225995334_jpg_67de820c56.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_CRCL_resized_jpg_eafa0166a7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_oil_neww_a4e4f5f75e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Boeing_jpg_48e7f3f6e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_figure_logo_OG_jpg_c0809abe4d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2221559761_jpg_71120b5aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)