Advertisement|Remove ads.

Netflix Stock Teases $1,000 Resistance After Streaming Giant Wows Sell-Side, Retail With Beat-And-Raise Quarter

Netflix, Inc. ($NFLX) analysts scrambled to raise their price targets for the stock following the streaming giant’s stellar quarterly results and price hike announcement.

In premarket trading, the stock jumped nearly 15% to $998.67. If these gains hold, the stock is on track to move into uncharted territory.

The fourth-quarter earnings report could reignite the stock rally that has lost steam in the new year. Netflix jumped 83% in 2024 but it currently traded 7.66% off its all-time high of $941.75 reached on Dec. 11.

Here’s a compilation of upward price target adjustments snagged by Netflix stock, according to TheFly.

- Baird maintained an ‘Outperform’ rating and upped the price target to $1,100 from $950.

- Rosenblatt Securities upgraded the stock to ‘Buy’ and notably raised the price target from $680 to $1,494.

- Guggenheim analysts maintained an ‘Outperform’ rating and lifted the price target to $1,100 from $950.

- Piper Sandler maintained an ‘Overweight’ rating and increased the price target to $1,100 from $950.

- Morgan Stanley, while rating Netflix an ‘Overweight,’ raised the price target to $1,150 from $1,050.

- BofA Securities kept a ‘Buy’ rating and moved up the price target to $1,175 from $1,000.

- KeyBanc Capital Markets maintained an ‘Overweight’ rating and raised the price target to $1,100 from $1,000.

- Bernstein maintained a ‘Market Perform’ rating and upwardly revised the price target to $975 from $780.

- JPMorgan maintained an ‘Overweight’ rating and upped the price target to $1,150 from $1,000.

- Macquarie analysts maintained an ‘Outperform’ rating and they raised the price target to $1,150 from $965.

- CANACCORD Genuity upgraded the stock to ‘Buy’ from ‘Hold’ and raised the price target to $1,1650 from $940.

- Pivotal Research has a ‘Buy’ rating, and a $1,250 price target, upwardly revised from $1,100.

- Barclays upgraded the stock to ‘Equal Weight’ from ‘Underweight.’

Q4 Results

Netflix, based in Los Gatos, California, reported fourth-quarter earnings per share (EPS) of $4.27 versus $2.11 a year ago. Revenue climbed 11.2% year-over-year (YoY) to $10.42 billion. Both metrics trumped the consensus estimates, which called for EPS of $4.21 and revenue of $10.11 billion.

The results were in line with predictions by the retail community on Stocktwits.

Global streaming paid net additions jumped to 18.91 million, up from 13.12 million a year ago and 5.07 million in the previous quarter. Total global streaming paid membership number is now at 301.63 million.

In a letter to shareholders, the company said, “The Jake Paul vs. Mike Tyson fight became the most-streamed sporting event ever, and on Christmas Day we delivered the two most-streamed NFL games in history.”

The streaming giant also announced price increases across most plans in the U.S., Canada, Portugal, and Argentina. The ad-supported service is now priced at $7.99 per month, up a dollar, and the premium package price was raised by 9% to $24.99.

Looking ahead, Netflix raised its 2025 revenue guidance to $43.5 billion to $44.5 billion, up $0.05 billion versus its previous forecast. Wall Street currently estimates revenue of $43.9 billion for the year.

The company said in April last year that it will cease to report membership numbers and ARM beginning in 2025.

Outlining its priorities, Netflix said it looks to improve its core business with more series and films and ad business growth. It also aims to develop new initiatives such as live programming and games.

Retail Mood

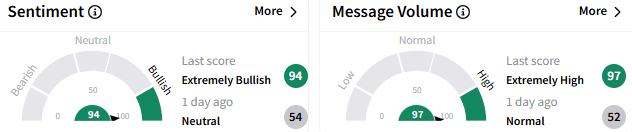

On Stocktwits, retail sentiment toward Netflix stock improved to ‘extremely bullish’ (94/100) from ‘neutral’ a day ago. Message activity perked up to ‘extremely high’ levels.

Netflix is the top trending stock on the platform, and it was among the top ten tickers based on retail activity.

A retail stock watcher flagged the stock as a ‘buy-and-hold’ investment. Another said the break above $1,000 could be “fast and violent.”

Some began clamoring for a stock split.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263890310_jpg_1f5b1fba80.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2185274983_jpg_0354a0740b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)