Advertisement|Remove ads.

Netflix Stock Plunges On Broader Market Weakness, Cautious Analyst Comments On Subscriber Growth: Retail’s Divided

Netflix, Inc. (NFLX) stock fell sharply Thursday, dragged by tech-led broader market weakness and a cautious commentary by an analyst regarding benefits accruing from the company’s password-sharing clampdown.

The market took a hit on Thursday after disappointing earnings reports from some high-profile names such as Marvell Technology, Inc. (MRVL) and the potential threat from Alibaba Group Holding Limited (BABA) launching an artificial intelligence (AI) reasoning model dented sentiment toward tech stocks.

While the tech-heavy Nasdaq Composite Index plunged over 2.50%, the broader S&P 500 fell a more modest 1.75%.

Netflix’s stock also reacted to a report from research firm Moffett Nathanson that said the subscriber boom the streaming giant experienced following its move to crack down on password sharing may soon taper away, Marketwatch reported

According to the firm, Netflix has gotten its users, who were previously using shared passwords, to subscribe.

Analysts at the firm said, “This implies that the elevated level of global subscriber growth for Netflix does not represent as significant an expansion of its user base.”

“Rather, it is leading to Netflix (very successfully) improving the monetization of its existing user base.”

MoffettNathanson expects the company to have strong subscriber growth for a few more quarters, thanks to its content slate and ad-tier. However, it sees the benefits of the password-sharing crackdown slowing down.

Netflix began cracking down on password sharing in May 2023, and since then, its subscriber numbers have surged.

The fourth quarter (Q4) report released in January showed its global streaming paid net additions jumping to 18.91 million from 13.12 million a year ago and 5.07 million in the previous quarter.

Total global streaming paid membership at the end of the quarter stood at 301.63 million.

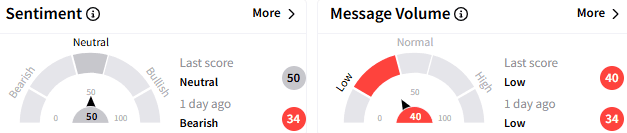

On Stocktwits, retail sentiment around the Netflix stock improved to ‘neutral’ (50/100) from the ‘bearish’ mood that prevailed a day ago. The message volume remained muted at ‘low’ levels.

A retailer watcher who is bearish on the stock said he would prefer to take some profit after its extended run.

Another watcher suggested the stock is a ‘buy’ only if it declines to the $300 level.

Netflix stock traded down over 5.75% at $933.89 by Thursday afternoon, marking the lowest level since Jan. 21. It has gained over 11% so far this year, following an 83% jump in 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Super Micro Stock Volatile After Analyst Predicts 80% Upside: Bull-Bear Tug Seen Among Retailers

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)