Advertisement|Remove ads.

Chartbuster Alert: Neuland Labs Soars Past Resistance On Bullish Technicals

Neuland Laboratories has staged an explosive breakout above the consolidation zone, with its shares rallying 15% on Monday.

SEBI-registered analyst Vijay Kumar Gupta noted that the heavy volumes confirm institutional buying, adding that strong earnings and bullish sector sentiment back the rally.

The trading volume has surged to 690.96K—the highest seen in several weeks. Technical indicators support this bullish move as the stock has broken decisively above the Ichimoku cloud. The Commodity Channel Index (CCI) stands at 307.91 (indicating overbought conditions but reflecting powerful breakout momentum), and On-Balance Volume (OBV) is spiking, confirming robust buying interest.

Gupta identified support between ₹12,700–₹12,750, with resistance now at fresh all-time highs, which shows that a trend following move is in the play.

Why Is Neuland Surging?

Neuland reported a robust first-quarter (Q1 FY26) earnings with net profit surging 85% year-on-year (YoY), led by strong growth in the CMS (Custom Manufacturing Solutions) segment and better realization in niche APIs.

In other recent developments, Neuland Labs announced a strategic multi-year contract with a leading US pharma player for peptide manufacturing, a high-margin segment.

Foreign Institutional Investor (FII) holding has increased marginally in the latest shareholding pattern, which is a bullish signal for long-term investors. The broader sector is also benefiting from favorable trends, as CDMO/API players are being rerated due to China+1 tailwinds, improved pricing environment, and margin expansion opportunities.

What To Watch

Looking ahead, Gupta suggested watching for a follow-through move above ₹14,000 that could take the stock to ₹15,500–₹16,000 in the short-to-medium term. Continued consolidation above ₹13,000, supported by strong volume, is considered a healthy sign, while any dip in the CCI or Relative Strength Index (RSI) may present a dip-buying opportunity.

He concluded that Neuland Labs is entering a high-growth, high-margin cycle with visibility from CMS contracts. Technically and fundamentally aligned breakout, which is ideal for momentum followers and growth investors.

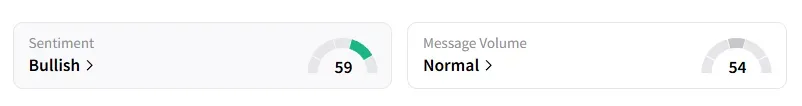

Retail sentiment has turned ‘bullish’ from ‘neutral’ last week on Stocktwits.

Neuland shares have risen 3% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)