Advertisement|Remove ads.

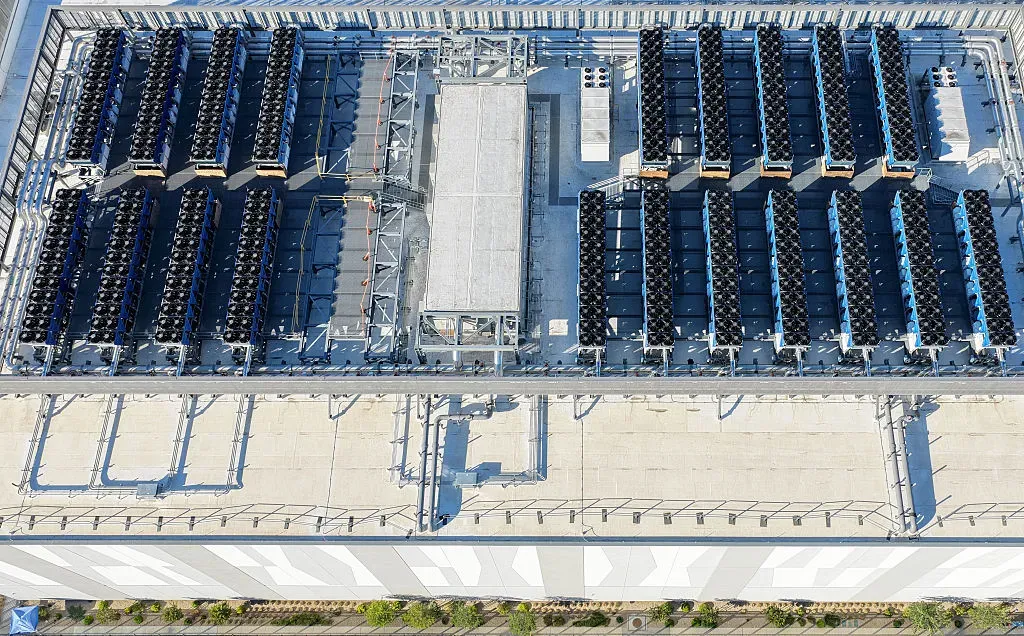

New Era Energy & Digital Expands Digital Infrastructure With Complete Texas Data Center Ownership

- The total value of the acquisition is $70 million, structured across cash, stock, and debt.

- Once the transaction closes, New Era will own the flagship hyperscale site outright.

- New Era has completed a separate land purchase, adding 203 adjacent acres, bringing the total campus to 438 acres.

New Era Energy & Digital, Inc. (NUAI) announced on Tuesday that it has struck a deal to take full control of a large hyperscale data center project in West Texas, expanding its infrastructure footprint.

The total value of the acquisition is $70 million, structured across cash, stock, and debt.

Complete Ownership

Under a legally binding purchase arrangement, New Era has agreed to buy the remaining 50% interest in Texas Critical Data Centers LLC (TCDC) from partner Sharon AI.

Once the transaction closes, New Era will own the flagship hyperscale site outright. TCDC sits on property near Odessa in Ector County, Texas, and is designed to support more than one gigawatt of computing capacity.

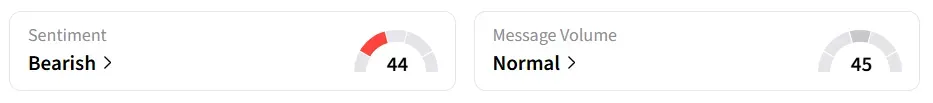

Following the announcement, New Era Energy stock traded over 1% in Tuesday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory while message volume changed to ‘normal’ from ‘low’ levels in 24 hours.

A Stocktwits user expressed optimism about the acquisition.

Deal Structure

Initially, the company will pay $10 million in cash, expected to be financed through non-equity sources. A second $10 million in shares is payable on March 31, 2026, and a senior secured note of $50 million will cover the remainder, of which $40 million is non-convertible debt.

“Full ownership allows us to align capital with development, accelerating the project's execution and creating stronger long-term value for NUAI shareholders.”

-E. Will Gray II, CEO, New Era Energy & Digital

In addition to the ownership deal, New Era has completed a separate land purchase, adding 203 adjacent acres, bringing the total campus to 438 acres.

The deal comes at a time when Fuzzy Panda has taken a short position in the stock, suggesting concerns about the company’s business practices and leadership. Fuzzy Panda alleged that the company’s plan to run AI data centers with old gas wells is unrealistic and likely unprofitable.

NUAI stock has lost over 28% in 2025 and gained over 52% in the last 12 months.

Also See: Tesla’s Demand Cools, But Canaccord Is Doubling Down – Raises Price Target To $551

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)