Advertisement|Remove ads.

New Fortress Stock Tumbles After Big Q1 Revenue Miss, Retail’s Bullish But Concerned About Debt

New Fortress Energy (NFE) stock slumped 31% in extended trading on Wednesday after the liquefied natural gas firm’s quarterly revenue fell short of Wall Street’s expectations.

The company reported first-quarter revenue of $470.5 million for the quarter ended March 31, while analysts expected it to post $614.5 million, according to FinChart data.

It reported a net loss of $197.4 million, or $0.73 per share, compared with a year-ago profit of $56.7 million, or $0.26 per share.

The company delayed the release of its earnings report earlier this week due to a delay in closing the $1.06 billion sale of its Jamaica assets to Excelerate Energy.

At the end of the first quarter, it had about $448 million in unrestricted cash, which it would primarily spend on Brazilian power projects.

The company has been grappling with issues related to debt repayments. Due to its high leverage, all three top rating agencies have downgraded its credit rating.

Last month, Fitch Ratings said the company’s free cash flow would be negative over the next two years.

“Expansion in Puerto Rico and timely commencement of operations in Brazil are key to generating additional liquidity and improving NFE's financial profile,” Fitch had noted.

New Fortress, which makes LNG and supplies power to utilities, expects its core earnings to be better than prior estimates in the second half of the year.

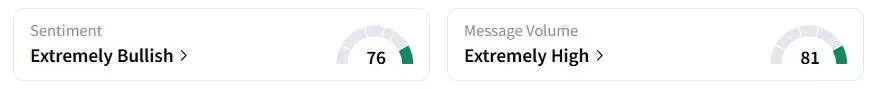

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (76/100) territory, while retail was ‘extremely high.'

One user said it is worth waiting until June to check the Puerto Rico contract.

“So basically we have all these plants but suppliers' hands are tied due to junk credit profile,” another user said.

New Fortress stock has fallen 55.9% year to date (YTD).

Also See: Nextracker Stock Gains After Upbeat Q4, Sees Robust Global Demand: Retail Mood Brightens

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)