Advertisement|Remove ads.

Newmont Stock Jumps Over 3% Premarket: Wall Street Analyst Sees 22% Upside, Retail Traders Feel Bullish

Newmont (NEM) stock gained more than 3% in premarket trading on Monday after Goldman Sachs turned bullish on the gold miner.

According to The Fly, the brokerage upgraded Newmont to ‘Buy’ from ‘Neutral’ and raised the price target to $104.30 from $77.30. The updated price target implies a 22.5% upside compared to the stock’s closing price on Friday.

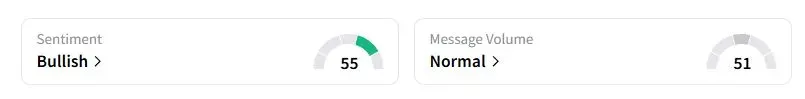

Newmont shares have fallen 3.2% over the past week, compared with gold’s 2.7% gains. Goldman Sachs reportedly cited the stock’s valuation for the upgrade following recent underperformance. Retail sentiment on Stocktwits about Newmont was in the ‘bullish’ territory at the time of writing.

The brokerage noted that Newmont's production growth, free cash flow yield, and capital management support its outlook. It also noted that the company trades at a discount compared to its peers. Newmont’s trailing price-to-earnings (P/E) ratio, a key gauge of valuation, stood at 15.4, compared with rival Barrick’s 20.6, according to Koyfin data.

Newmont and other gold miner stocks have rallied this year, banking on an over 54% jump in spot gold prices, aided by geopolitical uncertainty, and aggressive buying by central banks and retail investors. However, prominent analysts still believe that mining stocks have more room to run.

Last week, gold bull Peter Schiff said that despite the recent gains in gold and silver prices, mining stocks are yet to hit new highs as stock investors expect the precious metals to retreat. “When the correction they expect doesn’t happen, they will rush to buy back,” he said.

Newmont stock has more than doubled this year, making it the most valued mining company on the S&P 500 index. In late September, Newmont said CEO Tom Palmer will retire at the end of the year, handing over the reins of the company to Chief Operating Officer Natascha Viljoen. Under Palmer, Newmont solidified its position as the world’s biggest gold miner by acquiring Australia’s Newcrest for $17.2 billion.

Also See: Bitcoin, XRP, Ethereum Price Move: Cryptos Regain Ground After US-China Trade Tensions Ease A Bit

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)