Advertisement|Remove ads.

Pro-Trump Newsmax's Stock More Than Doubles After Dazzling Market Debut: Retail Piles In With Bearish Undercurrent

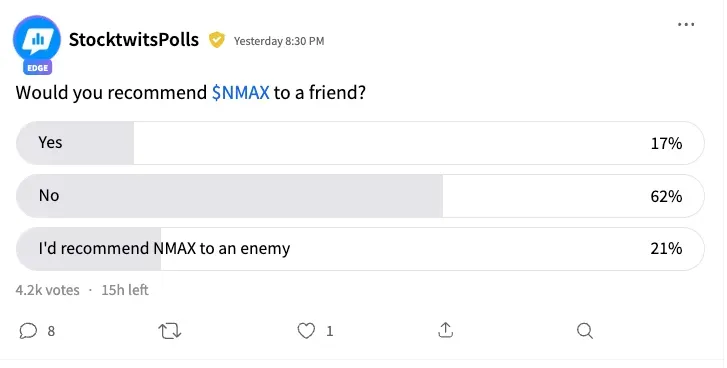

The incredible rally in the newly listed shares of Newsmax, Inc. (NMAX) continued into day two, with retail investors forming a highly bearish view but piling on nonetheless.

Shares of the TV news network gained 179% to close at $233 on Tuesday after climbing over 700% the previous day. In two days alone, NMAX shares are up a whopping 2,230% from the company's initial public offering (IPO) price of $10.

However, the stock pared some gains in after-market trading on Tuesday, suggesting investors were booking profits. As of the time of writing, NMAX was the fourth top-trending ticker on Stocktwits.

On Tuesday, the stock's retail following on the platform shot up by over 185%, while message volume soared by 277%, with sentiment ending on a 'bearish' note.

Newsmax now has a market capitalization of $30 billion, higher than media peers Fox Corp (FOXA), Warner Bros Discovery (WBD), News Corp (NWSA), Paramount Global (PARA), New York Times (NYT), and Trump Media & Technology Group (DJT).

According to CNBC, CEO Christopher Ruddy's one-third stake in the company is now valued at $9.1 billion.

Interactive Brokers Group Inc. (IBKR) founder Thomas Peterffy owns the second-largest stake worth $5.4 billion.

Newsmax is the fourth most prominent cable news network in the United States and is known for leaning towards Donald Trump and the Republicans.

The company started as a digital offering in 1998 before becoming a cable TV network in 2014.

Newsmax raised $75 million in the just-concluded IPO, following the private placement of its shares that raised $225 million.

On a Stocktwits post about the stock, a user commented that they made "a ton of money" buying and then selling the stock the same day and plan to do it again.

Comments ranged from "pump and dump" recommendations to expecting the stock to hit $1,200 in two weeks.

Elsewhere, a user said the "company is sinking," and they "can feel the rug coming," implying that the stock will lose its gains soon.

Shares of NMAX ended on Tuesday at $233, compared to the previous day's close of $83.51.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1248428688_jpg_059f14eab1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Palo_Alto_logo_1200pi_resized_jpg_eee56769fa.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_crash_490d43331a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_88435a6487.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)