Advertisement|Remove ads.

NextDecade Stock Gains After LNG Sale Deal With Aramco, Retail’s Divided

NextDecade (NEXT) stock gained 8.5% on Tuesday after the company executed a 20-year liquefied natural gas (LNG) sale and purchase agreement with a subsidiary of Aramco.

Under the deal terms, the Aramco subsidiary will buy 1.2 million tonnes per annum (MTPA) of LNG for 20 years, NextDecade said. The project also counts the United Arab Emirates’ ADNOC and Japan’s Itochu among its customers.

The contract is free-on-board, at a price indexed to Henry Hub, and is subject to a positive Final Investment Decision (FID) on Train 4 of the company's Rio Grande LNG facility.

“The Rio Grande LNG Facility continues to attract outstanding LNG customers, which we believe is a testament to the quality of our project,” CEO Matt Schatzman said.

The companies had signed a non-binding agreement last year.

Last month, a U.S. court allowed the construction of its Rio Grande liquefied natural gas (LNG) facility to proceed, revising its earlier order.

The project, which lies on the north shore of the Brownsville Ship Channel in Texas, has already faced multiple delays.

In February, the TotalEnergies-backed company revealed plans to boost LNG production capacity at Rio Grande by adding three more trains.

Barring any new developments, NextDecade has the regulatory approvals and authorizations required to export up to 27 MTPA of LNG from the five trains at the Rio Grande.

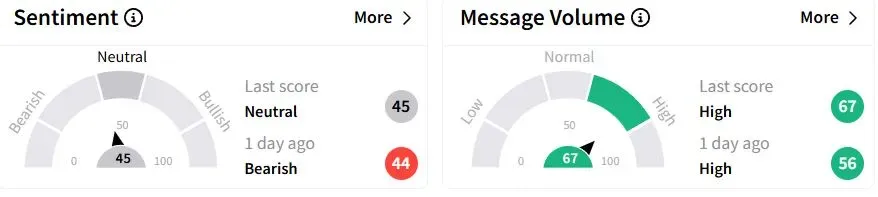

Retail sentiment on Stocktwits moved to ‘neutral’ (45/100) territory from ‘bearish’(44/100) a day ago, while retail chatter was ‘high.’

The stock's message volume rose 150% compared to the previous day.

NextDecade stock has fallen 16.9% year-to-date (YTD).

Also See: Delta Airlines Q1 Preview: Wall Street Concerned About Demand Amid Tariff Fallout, Retail’s Split

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_verastem_jpg_8ed70d9d9a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_with_others_OG_jpg_86ee42eaf9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rigetti_resized_jpg_4e393f1208.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_bitcoin_OG_jpg_fbd13fff2e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)