Advertisement|Remove ads.

Delta Airlines Q1 Preview: Wall Street Concerned About Demand Amid Tariff Fallout, Retail’s Split

Delta Airlines (DAL) stock has fallen 13.4% over the past week ahead of its quarterly earnings report on Wednesday before the markets open.

According to FinChat data, Wall Street expects the company to post first quarter earnings per share (EPS) of $0.86 on revenue of $13.66 billion. The company has topped analysts’ expectations in two of the four quarters.

Investors will closely watch the carrier’s earnings report amid concerns over a slowdown in passenger demand due to fears of recession.

The airline has already cut its revenue growth expectations to the range of 3% to 4% in the first quarter (Q1) of 2025 compared to its initial forecast of 7% to 9% growth.

Delta also lowered its operating margin forecast to 4% to 5% from the 6% to 8% projected earlier.

According to TheFly, UBS analysts downgraded the stock last week, citing a weaker economic backdrop and “increasing visibility to a potential recession.”

The brokerage noted that it does not expect the company to be immune to the significant cyclical pressure that typically occurs during an economic downturn.

It added that the current backdrop of a weaker economic outlook and the sharp rise in tariffs would likely cause a deterioration in both international and premium segments, which poses a significant risk to the company.

While Raymond James analysts noted that despite the steep cut in Q1 forecast, the brokerage continues to see unique structural advantages at Delta compared with legacy airline peers, supporting a margin advantage.

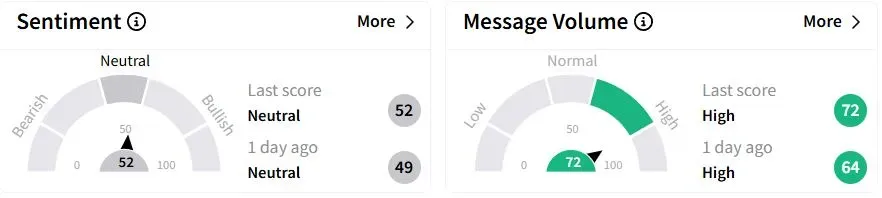

Retail sentiment on Stocktwits was in the ‘neutral’ (52/100) territory, albeit with a higher score than a day ago, while retail chatter was ‘high.’

One self-confessed “Delta bull” did not see good outcomes from Wednesday.

Another investor said that the dip represented a buying opportunity.

Delta stock has fallen 40.5% year-to-date (YTD).

Also See: Boeing Stock Gains After Logging Highest Quarterly Deliveries Since 2023, Retail’s Bullish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jim_cramer_OG_2_jpg_b3d8e3bbe7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)